UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ___)

Filed by the Registrant [ X ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a -12

SECURITY DEVICES INTERNATIONAL INC.

(Name of Registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement), if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of

transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) |

Amount Previously Paid: |

|

| (2) |

Form, Schedule or Registration Statement No.: |

|

| (3) |

Filing Party: |

|

| (4) |

Date Filed: |

SECURITY DEVICES INTERNATIONAL INC.

2014 Annual Meeting of Stockholders

Proxy Statement

2

SECURITY DEVICES INTERNATIONAL INC.

1101 PENNSYLVANIA AVE. NW, 6TH FLOOR

WASHINGTON • DC • USA • 20004

Notice of Annual Meeting of Stockholders

To all Stockholders of Security Devices International Inc.:

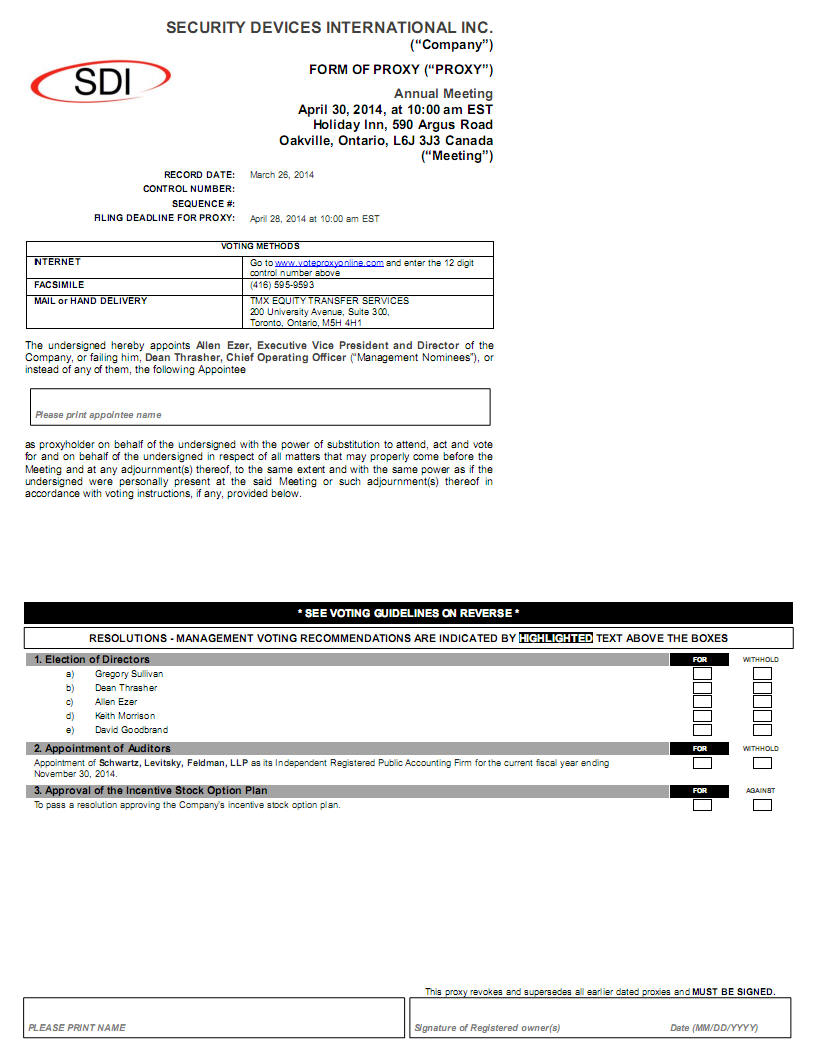

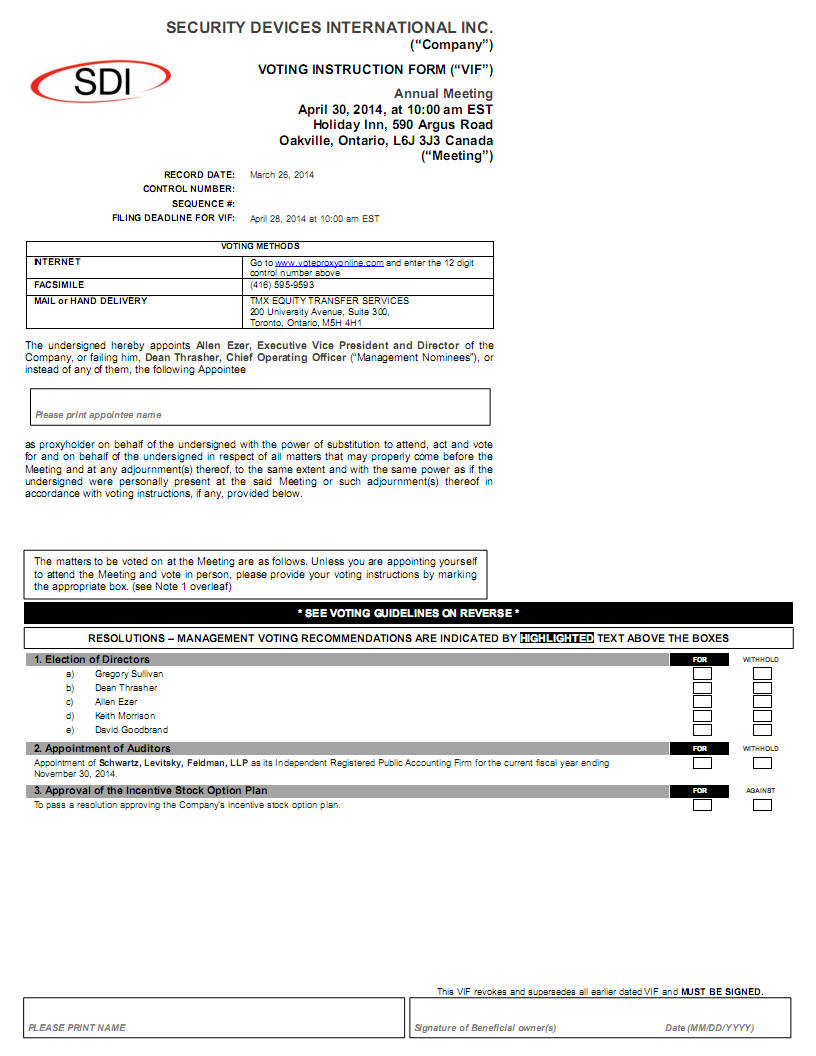

You are invited to attend the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Security Devices International Inc. (the “Company”). The Annual Meeting will be held at the Holiday Inn, 590 Argus Road, Oakville, ON L6J 3J3 Canada, on April 30, 2014, at 10:00 am EST. The purposes of the Annual Meeting are:

| 1. |

The election of the Nominees to the Company’s Board of Directors to serve until the Company’s 2015 Annual Meeting of Stockholders or until successors are duly elected and qualified; the following are Nominees for election as directors: Gregory Sullivan, Dean Thrasher, Allen Ezer, Keith Morrison, and David Goodbrand; |

|

| 2. |

To ratify the appointment of the Company’s independent registered public accounting firm for fiscal year 2014; |

|

| 3. |

To pass a resolution approving the Company’s incentive stock option plan; and |

|

| 4. |

Any other business that may properly come before the annual meeting. |

The Board of Directors has fixed March 26, 2014 as the record date for the Annual Meeting. Only stockholders of the Company of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders as of March 26, 2014 will be available for inspection by any stockholder at our principal place of business, 300-125 Lakeshore Road East, Oakville, Ontario L6J 1H3 Canada, starting April 8, 2014, during normal business hours, and at the Annual Meeting

Stockholders will need to register at the Annual Meeting to attend the Annual Meeting. If your shares of common stock are not registered in your name, you will need to bring proof of your ownership of those shares of common stock to the Annual Meeting in order to register. You should ask the broker, bank or other institution that holds your shares of common stock to provide you with a proxy that shows your ownership of shares of common stock of the Company as of March 26, 2014. Please bring that documentation to the Annual Meeting to register.

IMPORTANT

Whether or not you expect to attend the Annual Meeting, please sign and return the enclosed proxy promptly. If you decide to attend the Annual Meeting, you may, if you wish, revoke the proxy and vote your shares of common stock in person.

By Order of the Board of Directors,

Dean Thrasher, Secretary

Washington, DC

March 26, 2014

SECURITY DEVICES INTERNATIONAL INC.

1101 PENNSYLVANIA AVE. NW, 6TH FLOOR

WASHINGTON • DC • USA • 20004

3

Proxy Statement

for the

Annual Meeting of Stockholders

To Be Held April 30, 2014

Unless the context requires otherwise, references in this proxy statement to “SDI,” the “Company,” “we,” “us,” or “our” refer to Security Devices International Inc.

The Annual Meeting of Stockholders (the “Annual Meeting”) will be held at the Holiday Inn, 590 Argus Road, Oakville, ON L6J 3J3 Canada, on April 30, 2014, at 10:00am EST. We are providing the enclosed proxy materials and form of proxy in connection with the solicitation by our Board of Directors (the “Board”) of proxies for this Annual Meeting. This proxy statement (the “Proxy Statement”) will first be mailed to holders of our voting stock on or about April 8, 2014.

You are invited to attend the Annual Meeting at the above stated time and location. If you plan to attend and your shares of common stock are held in “street name” – in an account with a bank, broker, or other nominee- you must obtain a proxy issued in your name from such broker, bank or other nominee.

You can vote your shares of common stock by completing and returning the proxy card or, if you hold shares in “SDI,” by completing the voting form provided by the broker, bank or other nominee. A returned signed proxy card without an indication of how shares of common stock will be voted FOR the ratification of our independent registered public accounting firm.

A returned proxy card without an indication of how shares of common stock should be voted will count towards the determination of a quorum and will be cast as votes FOR the following proposals: (1) the election of all nominees (“Nominees”) as directors of the Board (“Directors”) and (2) the approval of the Incentive Stock Option Plan (the “2013 Plan”). We encourage our stockholders to instruct their brokers to vote their shares of common stock on each of the proposals.

Our corporate bylaws (the “Bylaws”) define a quorum as one-third of the voting power of the issued and outstanding voting stock present in person or by proxy. The nominees who receive the most votes will be elected. A simple majority of the voting shares present, whether in person or by proxy, is required to ratify the appointment of our independent registered public accounting firm.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND VOTING

Why am I receiving this Proxy Statement and proxy card?

You are receiving this Proxy Statement and proxy card because you were a stockholder of record at the close of business on March 26, 2014, and are entitled to vote at the Annual Meeting. This Proxy Statement describes issues on which we would like you, as a stockholder, to vote. It provides information on these issues so that you can make an informed decision. You do not need to attend the Annual Meeting to vote your shares of common stock.

When you sign the proxy card you appoint Gregory Sullivan, our Chief Executive Officer, and if Mr. Sullivan is unavailable, Dean Thrasher, our Chief Operating Officer and Secretary, as your representative at the Annual Meeting. As your representatives, they will vote your shares of common stock at the Annual Meeting (or any adjournments or postponements) as you have instructed them on your proxy card. With proxy voting, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, it is a good idea to complete, sign and return your proxy card in advance of the Annual Meeting, just in case your plans change.

If an issue comes up for vote at the Annual Meeting (or any adjournments or postponements) that is not described in this Proxy Statement, your representative will vote your shares of common stock, under your proxy, at their discretion, subject to any limitations imposed by law.

4

When is the record date?

The Board has fixed March 26, 2014, as the record date for the Annual Meeting. Only holders of shares of our voting stock as of the close of business on that date will be entitled to vote at the Annual Meeting.

How many shares are outstanding?

As of March 26, 2014, we had 46,849,285 shares of common stock issued and outstanding.

What am I voting on?

You are being asked to vote on the following:

| 1. |

The election of the Nominees to the Company’s Board of Directors to serve until the Company’s 2015 Annual Meeting of Stockholders or until successors are duly elected and qualified; the following are Nominees for election as directors: Gregory Sullivan, Dean Thrasher, Allen Ezer, Keith Morrison, and David Goodbrand; |

|

| 2. |

To ratify the appointment of the Company’s independent registered public accounting firm for fiscal year 2014; |

|

| 3. |

To pass a resolution approving the 2013 Plan; and |

|

| 4. |

Any other business that may properly come before the annual meeting. |

How many votes do I get?

Each share of common stock is entitled to one vote. No cumulative rights are authorized, and dissenters’ rights are not applicable to any of the matters being voted upon.

The Board recommends a vote FOR each of the Nominees to the Board, FOR the ratification of the appointment of our independent registered public accounting firm, and FOR the 2013 Plan.

How do I vote?

You have several voting options. You may vote by:

If your shares of common stock are held in an account with a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares of common stock held in a “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares of common stock in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares of common stock in person at the Annual Meeting unless you request and obtain a valid proxy card from your broker, bank, or other nominee.

Can stockholders vote in person at the Annual Meeting?

We will pass out written ballots to anyone who wants to vote at the Annual Meeting. If you hold your shares of common stock through a brokerage account but do not have a physical share certificate, or the shares are registered in someone else’s name, you must request a legal proxy from your stockbroker or the registered owner to vote at the Annual Meeting.

5

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting by:

How many votes do you need to hold the Annual Meeting?

To conduct the Annual Meeting, we must have a quorum, which means that one-third of our outstanding voting shares as of the record date must be present at the Annual Meeting. Based on 46,849,285 shares of common stock issued and outstanding as of March 26, 2014, 15,616,428 shares of common stock must be present, in person or by proxy, for a quorum to be present at the Annual Meeting.

Your shares will be counted as present at the Annual Meeting if you:

What if I abstain from voting?

Abstentions with respect to a proposal are counted for the purposes of establishing a quorum. If a quorum is present, abstentions will not be included in vote totals. Since our bylaws provide that approval of a proposal at an Annual Meeting of the stockholders is by the affirmative vote of a majority of the voting shares present, in person or by proxy, at a Annual Meeting of the stockholders, a properly executed proxy card marked ABSTAIN with respect to a proposal will have the same effect as voting AGAINST that proposal. However, as described below, election of Directors is by a plurality of the votes cast at the Annual Meeting. A properly executed proxy card marked WITHHELD with respect to the election of Directors will not be voted and will not count FOR any of the Nominees for which the vote was withheld.

What effect does a broker non-vote have?

Brokers and other intermediaries, holding shares of common stock in street name for their customers, are generally required to vote the shares of common stock in the manner directed by their customers. If their customers do not give any direction, brokers may vote the shares of common stock on routine matters, but not on non-routine matters. The following proposals are non-routine matters: (1) the election of the Nominees as Directors; (2) the approval of the 2013 Plan, therefore, brokers may not vote shares of common stock held in street name for their customers in relation to these items of business. The ratification of the appointment of our independent registered public accounting firm for the fiscal year of 2013 is considered a routine matter and brokers will be permitted to vote shares of common stock held in street name for their customers.

The absence of a vote on a non-routine matter is referred to as a broker non-vote. Any shares of common stock represented at the Annual Meeting but not voted (whether by abstention, broker non-vote or otherwise) will have no impact in the election of Directors, except to the extent that the failure to vote for an individual results in another individual receiving a larger proportion of votes cast for the election of Directors. Any shares of common stock represented at the Annual Meeting but not voted (whether by abstention, broker non-vote or otherwise) with respect to the proposal to approve the Stock Option Plan, this will have the same effect as a vote against such proposal. In recognition of our desire to have every stockholder vote count, we encourage our stockholders to instruct their brokers to vote their shares.

6

How many votes are needed to elect Directors?

The Nominees for election as Directors at the Annual Meeting will be elected by a plurality of the votes cast at the Annual Meeting. The Nominees with the most votes will be elected. A properly executed proxy card marked WITHHELD with respect to the election of Directors will not be voted and will not count FOR or AGAINST any of the Nominees.

How many votes are needed to ratify the appointment of the independent registered public accountant?

The ratification of the appointment of the independent registered public accountant will be approved if a majority of the voting shares present at the Annual Meeting vote FOR the proposal. A properly executed proxy card marked ABSTAIN with respect to this proposal will have the same effect as a vote cast AGAINST this proposal.

How many votes are needed to approve the 2013 Plan?

The Stock Option Plan will be approved if a majority of the voting shares present at the Annual Meeting vote FOR the proposal. A properly executed proxy card marked ABSTAIN with respect to this proposal will have the same effect as a vote cast AGAINST this proposal.

Will my shares of common stock be voted if I do not sign and return my Proxy Card?

If your shares of common stock are held through a brokerage account, your brokerage firm, under certain circumstances, may vote your shares of common stock. See “What effect does a broker non-vote have?” above for a discussion of the matters on which your brokerage firm may vote your shares of common stock.

If your shares of common stock are registered in your name, and you do not sign and return your proxy card, your shares of common stock will not be voted at the Annual Meeting, unless you attend the Annual Meeting and vote your shares of common stock.

How are votes counted?

Your shares of common stock will be voted as you indicate on your proxy card. If you just sign your proxy card with no further instructions, your shares of common stock will be voted:

Voting results will be tabulated and certified by the Inspector of Elections.

Where can I find the voting results of the Annual Meeting?

We will publish the final results in a current report filing on Form 8-K with the United States Securities and Exchange Commission (the “SEC”) within four (4) business days of the Annual Meeting.

Who will pay for the costs of soliciting proxies?

We will bear the cost of soliciting proxies. In an effort to have as large a representation at the Annual Meeting as possible, our directors, officers and employees may solicit proxies by telephone or in person in certain circumstances. These individuals will receive no additional compensation for their services other than their regular salaries. Additionally, we may hire a proxy solicitor to help reach the quorum requirement. We will pay a reasonable fee in relation to these services. Upon request, we will reimburse brokers, dealers, banks, voting trustees and their nominees who are holders of record of our common stock on the record date for the reasonable expenses incurred for mailing copies of the proxy materials to the beneficial owners of such shares.

7

When are stockholder proposals due for the 2015 Annual Meeting of Stockholders?

In order to be considered for inclusion in the 2014 proxy statement, stockholder proposals must be submitted in writing to our Secretary, Dean Thrasher, at Security Devices International Inc., 300-125 Lakeshore Road East, Oakville, ON L6J 1H3 Canada, and received no later than October 1, 2014, provided that this date may be changed in the event that the date of the annual meeting of stockholders to be held in calendar year 2015 is changed by more than 30 days from the date of this Annual Meeting.

Are there any proposals currently anticipated for the 2015 Annual Meeting of Stockholders?

In addition to common shares, the Company is currently authorized to issue 5,000,000 shares of preferred stock. Shares of preferred stock may be issued from time to time in one or more series as may be determined by SDI's Board of Directors. The voting powers and preferences, the relative rights of each such series and the qualifications, limitations and restrictions of each series would need to be established by the Board of Directors. While not currently anticipated, SDI's directors are able to issue preferred stock with multiple votes per share and dividend rights which would have priority over any dividends paid with respect to the holders of SDI's Common Shares. The issuance of preferred stock with these rights may make the removal of management difficult even if the removal would be considered beneficial to shareholders generally, and will have the effect of limiting shareholder participation in transactions such as mergers or tender offers if these transactions are not favored by SDI's management. As of the date of this proxy statement SDI had not issued any shares of preferred stock and as of the date of this proxy statement SDI’s Board has no intention to issue any shares of preferred stock. Further and as a condition precedent to the TSXV issuing its final acceptance of listing of the Company’s common shares on the TSXV, SDI provided an undertaking in writing to the TSXV to: i) not issue any shares of preferred stock with multiple votes per share for so long as the Common Shares may be listed on the TSXV; and ii) present to its shareholders for approval an amendment to SDI’s constating documents to prohibit the issuance of shares of preferred stock having multiple voting attributes. SDI intends to include such an item of special business at its next annual or special meeting of stockholders.

How can I obtain a copy of the Annual Report on Form 10-K or our Audited Financial Statements?

Our Audited Financial Statements are included in our Annual Report on Form 10-K and are available on the Internet at the SEC’s website at http://www.sec.gov. At the written request of any stockholder who owns shares of common stock on the record date, we will provide to such stockholder, without charge, a paper copy of our Financial Statements as filed with the SEC, but not including exhibits. If requested, we will provide copies of the exhibits for a reasonable fee. Requests for additional paper copies of the Financial Statements should be mailed to:

1101 Pennsylvania Ave. NW, 6th Floor

Washington, DC

20004 USA

Attention: Allen Ezer, Executive Vice President

Additional information relating to the Company is also available on SEDAR at www.sedar.com. Financial information concerning the Company is provided in the comparative financial statements for the year ended November 30, 2013 and Management Discussion & Analysis (MD&A) for that financial year. Securityholders may contact the Company to request copies of the Company’s financial statements and MD&A at the address set out above.

8

PROPOSAL 1 — ELECTION OF DIRECTORS GENERAL QUESTIONS

What is the current composition of the Board?

Our current bylaws require the Board to have at least one (1) and no more than ten (10) Directors. The current Board is composed of five (5) Directors, of which three (3) are standing for re-election, and two (2) are being nominated. Dean Thrasher, a current director standing for election, was appointed to the Board on November 26, 2013.

Is the Board divided into classes? How long is the term?

No, the Board is not divided into classes. All Directors serve one-year terms until their successors are elected and qualified at the next annual meeting of our stockholders.

Who is standing for election this year?

The Board has nominated the following five (5) Nominees, for election at the Annual Meeting, to hold office until the 2014 Annual Meeting:

What if a Nominee is unable or unwilling to serve?

Should any one or more of these Nominees become unable or unwilling to serve, which is not anticipated, the Board may designate substitute nominees, in such event, the proxy representatives will vote proxies that otherwise would be voted for the named Nominees for the election of such substitute nominee or nominees.

How are Nominees elected?

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting.

The Board recommends a vote FOR each of the Nominees. All proxies executed and returned without an indication of how shares of common stock should be voted will be voted FOR the election of all Nominees.

INFORMATION ON THE BOARD, EXECUTIVE OFFICERS, AND KEY EMPLOYEES AND DIRECTOR NOMINEES

The following table and information that follows sets forth, as of March 26, 2014, the names, and positions of our directors and executive officers:

9

| Name and Municipality of Residence | Current Office with

the Company |

Principal Occupation Last Ten Years |

Director Since |

| Gregory Sullivan

Hamilton, Ontario, Canada |

Chief Executive Officer, Director |

Chief Executive Officer appointed July 2010, Police Officer from August 1985 – April 2012. |

April 2005 |

| Rakesh Malhotra Mississauga, Ontario, Canada |

Chief Financial Officer and Treasurer |

Chief Financial Officer appointed January 2007, a Canadian Chartered Accountant in Ontario and a Certified Public Accountant in Illinois. His occupation is that of a consultant to various private and public companies in Canada and the USA and serving as CFO with various public companies. |

- |

| Dean Thrasher Burlington, Ontario, Canada |

Chief Operating Officer |

COO of since Oct 2010; self-employed (investment banking) from December 2007 to present; Executive Vice President, Mint Technology Corp. (TSXV pre-paid credit cards) July 2002 to December 2007; President, ecwebworks Inc. (e- commerce) from June 1999 to July 2002. |

November 2013 |

| Allen Ezer Mississauga, Ontario, Canada |

Executive Vice-President, |

Serving as VP Corporate Development January 2012, and as Executive Vice-President since January 2013; director with Goldspike Exploration (TSXV mineral exploration corporation) since May 2012, as well as Cambrian Corp. (junior exploration); CIBC Wood Gundy from November 2002 to December 2011, associate investment advisor. |

January 2012 |

| Keith Morrison Oakville, Ontario, Canada |

Director (Nominee) |

Chief Executive Officer at Gedex Inc. September 2008 to present. October 2012 to present; Director with Marengo Mining Ltd., (TSX: MRN). |

|

| David Goodbrand Shanty Bay, Ontario, Canada |

Director |

Police Sergeant September 1994 to present. |

October 2012 |

The following is a description of the business background of our directors, executive officers and director nominees. Gregory Sullivan, 49, Mr. Sullivan has been a Director of the Company since April 2005. Mr. Sullivan was a police officer from August 1985 to April 2012 in Ontario in numerous capacities. Mr. Sullivan graduated from Mohawk College in 1986 with a Law Enforcement degree.

Rakesh Malhotra, 57, Mr. Malhotra has been SDI's Chief Financial Officer since January 7, 2007. Mr. Malhotra is a certified public accountant in Illinois, and a Canadian chartered accountant in Ontario. Mr. Malhotra graduated with a Bachelor of Commerce (Honours) from the University of Delhi (India), and has served as CFO for Pacific Copper Corp. (OTC-BB Mining Exploration) from April 2007 to October 2013; Infrastructure Materials Corp. (OTC-BB and TSXV Mining Exploration) from October 2009 to present; Dynamic Fuel Systems Inc. (TSXV Manufacturing) from June 2009 to June 2011 and June 2013 to present; Uranium Hunter Corp. (OTC-BB Mining Exploration) from March 2007 to March 2010; Yukon Gold Corporation Inc. (OTC-Pink Sheets Mining Exploration) from November 2005 to August 2010 and November 2011 to present (filing on Sedar).

10

Dean Thrasher, 50, Mr. Thrasher has been COO for the Company since October 2010. Mr. Thrasher has been self-employed in the investment banking sector dating from December 2007 to present; Executive Vice President of Mint Technology Corp. (TSXV pre-paid credit cards) July 2002 to December 2007; and President, ecwebworks Inc. (e-commerce) from June 1999 to July 2002.

Allen Ezer, 37, Mr. Ezer has been a director and Executive Vice-President of the Company since January 2012. Mr. Ezer has been a director with Goldspike Exploration (TSXV mineral exploration corporation) since May 2012, as well as Cambrian Corp. (junior exploration); CIBC Wood Gundy November 2002 to December 2011, associate investment advisor.

David Goodbrand, 42, Mr. Goodbrand has served as a director for the Company since October 2012. Mr. Goodbrand is currently a police sergeant and has served in this capacity from September 1994 to present.

Keith Morrison, 54, Mr. Morrison currently serves as the Chief Executive Officer of Gedex Inc., and has done so since September 2008; Director of Aeroquest International (TSX:AQL) 2006 to 2012 (a global airborne geophysical services company); Director or Marengo Mining Ltd. October 2012 to present (TSX:MRN) an exploration company. Relationships between Directors and Officers There are no family relationships between any officer or director of SDI.

Arrangements between Directors and Officers

To our knowledge, there is no arrangement or understanding between any of our officers and any other person pursuant to which the officer was selected to serve as an officer.

Legal Proceedings, Cease Trade Orders and Bankruptcy

In November of 2013, a former officer filed a suit against the Company in the Ontario Superior Court of Justice (Province of Ontario) seeking, among other things, $60,000 in damages for wrongful dismissal, damages of $35,000 on account of vacation pay and damages to be determined for out of pocket expenses, breach of contract, unjust enrichment and loss of business opportunity. Management of the Company believes this suit is without merit and the Company intends to vigorously defend against the suit and as such no provision for any potential payment has been expensed.

Except as noted below, to our knowledge, none of our directors, executive officers or any of our stockholders holding more than 5% of any class of our voting securities, or any associate of any such director, officer or stockholder is a party adverse to us or any of our subsidiaries or has an interest adverse to us or any of our subsidiaries. None of our directors or executive officers is, as of the date of this Proxy Statement, or was within 10 years before the date of this Proxy Statement, a director, chief executive officer or chief financial officer of any company (including the Company), that:

| (a) |

was subject to a cease trade order (except as listed below), an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer; or |

|

| (b) |

was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

On October 28, 2008, Pacific Copper Corp., a US SEC filer received a cease trade order (the “CTO”) from the British Columbian Securities Commission (the “BCSC”). By its terms, the CTO was issued for not filing a technical report under ‘Canadian National Instrument 43-101 Standards of Disclosure for mineral projects (“NI 43-101”) with respect to its material copper oxide projects in Chile in support of mineral reserve and mineral reserve estimates and results of a preliminary assessment, after having made public disclosures regarding such properties. On May 8, 2009, the BCSC revoked its CTO against the Company. In order to comply with legislation, Pacific Copper Corp. filed technical reports under Canadian National Instrument 43-101 with respect to each of the mineral projects.

11

On March 8, 2012, Pacific Copper Corp. received an additional CTO from the BCSC, the effect of which is limited to the Province of British Columbia. The CTO was issued for failure to file comparative annual financial statements for its financial year ended October 31, 2011 as required under Part 4 of National Instrument 51-102 Continuous Disclosure Obligations ("NI 51-102") and section 5(b) of British Columbia Instrument 51-509 Issuers Quoted in the U.S. Over-the-Counter Markets ("BCI 51-509"); a Form 51-102F1 Management's Discussion and Analysis for the period ended October 31, 2011 as required under Part 5 of NI 51-102 and section 5(b) of BCI 51-109; and a Form 51-102F2 Annual Information Form for the year ended October 31, 2011 as required under section 5(c) of BCI 51-509. Pacific Copper Corp. filed its annual financial statements for its financial year ended October 31, 2011, Form 51-102F1 Management's Discussion and Analysis for period ended October 31, 2011, and Form 51-F2 Annual Information Form for the year ended October 31, 2011. As a result, on March 15, 2012, the BCSC revoked the CTO issued on March 8, 2012. Mr. Malhotra, SDI’s CFO was at the time and is no longer the CFO for Pacific Copper Corp.

None of our directors or executive officers, and none of our stockholders holding a sufficient number of our securities to affect materially the control of the Company:

| (a) |

is, as at the date of this Proxy Statement, or has been within the 10 years before the date of this annual report, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

|

| (b) |

has, within 10 years before the date of this Proxy Statement, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director, executive officer or stockholder; or |

|

| (c) |

has, within 10 years before the date of this Proxy Statement, been the subject of, or a party to, any U.S. federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (i) any U.S. federal or state securities or commodities law or regulation; or (ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

|

| (d) |

has, within 10 years before the date of this Proxy Statement, been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the United States Exchange Act of 1934, as amended (15 U.S.C.78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C.1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

None of our directors, executive officers nor any stockholder holding 5% any of our securities has been subject to:

12

| (a) |

any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

|

| (b) |

any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision. |

13

CORPORATE GOVERNANCE

THE BOARD STRUCTURE

General Structure

Our current bylaws require the Board to have at least one (1) and no more than ten (10) Directors. The current Board is composed of five (5) directors.

Director Independence

We have five (5) directors as at March 26, 2014, including two independent directors, as follows:

An “independent” director is a director whom the Board has determined satisfies the requirements for independence under the Sarbanes-Oxley Act of 2002, section 10A(m)(3) and under section 803A of the NYSE MKT LLC Company Guide. Duane Parnham will not be standing for re-election.

If elected, Keith Morrison, would be considered an independent director.

Board Leadership Structure

The Company’s Board of Directors is responsible for overseeing the business and affairs of the Company. Members of the Board are kept informed of our business through discussions with the President and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

The Board is currently comprised of Gregory Sullivan, who serves as our Chairman and President, and two independent directors and two directors who are not independent. The Board believes that there is no single best organizational model that is the most effective in all circumstances and that the shareholders’ interests are best served by allowing the Board to retain the flexibility to determine the optimal organizational structure for the Company at a given time, including whether the Chairman role should be held by an independent director or a senior executive who serves on the Board.

MEETINGS OF THE BOARD AND BOARD MEMBER ATTENDANCE

OF ANNUAL MEETING

During the fiscal year ended November 30, 2013, the Board held 2 meetings of the Board. None of the incumbent Directors attended fewer than 100% of the Board meetings held while they were a Director.

Board members are not required to attend the Annual Meeting.

COMMUNICATIONS TO THE BOARD

Stockholders who are interested in communicating directly with members of the Board, or the Board as a group, may do so by writing directly to the individual Board member c/o Secretary, Dean Thrasher, Security Devices International Inc., 1101 Pennsylvania Ave. NW, 6th Floor, Washington, DC 2004. Our Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. Our Secretary will review all communications before forwarding them to the appropriate Board member.

14

BOARD COMMITTEES

Our Board has established one board committee: the Audit Committee. The Board expects to create a Compensation Committee, and Corporate Governance and Nominating Committee in the coming fiscal year.

The information below sets out the current members of our Audit Committee and summarizes the functions of such committee.

Audit Committee and Audit Committee Financial Experts

Our Audit Committee is comprised of Gregory Sullivan, Duane Parnham, and David Goodbrand. Mr. Parnham and Mr. Goodbrand are independent directors under MI 52-110, Section 10A-3 of the Exchange Act and the audit committee rules of the NYSE MKT LLC. Gregory Sullivan is the Chairman of the Audit Committee. Gregory Sullivan satisfies the criteria for an audit committee financial expert under Item 407(d)(5) of Regulation S-K of the rules of the Securities and Exchange Commission.

The Audit Committee will meet with management and our external auditors if necessary, to review matters affecting financial reporting, the system of internal accounting and financial controls and procedures and the audit procedures and audit plans. The Audit Committee reviews our significant financial risks, will be involved in the appointment of senior financial executives and will annually review our insurance coverage and any off-balance sheet transactions.

The Audit Committee is mandated to monitor our audit and the preparation of financial statements and to review and recommend to the Board all financial disclosure contained in our public documents. The Audit Committee is also mandated to appoint external auditors, monitor their qualifications and independence and determine the appropriate level of their remuneration. The external auditors report directly to management, the Audit Committee and to the Board. The Audit Committee and the Board each have the authority to terminate the external auditor’s engagement (subject to confirmation by stockholders). The Audit Committee will also approve in advance any services to be provided by the external auditors, which are not related to the audit.

During the fiscal year ended November 30, 2013, the Audit Committee met once. The Audit Committee expects to meet as needed during the upcoming fiscal year.

Audit Committee Report

Our Audit Committee oversees our financial reporting process on behalf of the Board. The Committee has three members, two of which are “independent” as determined under Rule 10A-3 of the Exchange Act, and the rules of the NYSE MKT LLC. The Committee operates under a written charter adopted by the Board.

The Committee assists the Board by overseeing (1) the integrity of our financial reporting and internal control, (2) independence and performance of our independent auditors, (3) and provides an avenue of communication between management, the independent auditors, and the Board.

In the course of providing its oversight responsibilities regarding the 2013 financial statements, the Audit Committee will be reviewing the 2013 audited financial statements, with management and our independent auditors. The Audit Committee reviewed accounting principles, practices, and judgments as well as the adequacy and clarity of the notes to the financial statements.

The Audit Committee may meet with the independent auditors to discuss their audit plans, scope and timing on a regular basis, with or without management present. The Committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board for independent auditor communications with Audit Committees concerning independence, as may be modified or supplemented.

15

The Audit Committee and the Board have recommended the selection of Schwartz, Levitsky, Feldman, LLP as our independent auditors for the fiscal year ending November 30, 2014.

Compensation Committee

The Company does not have a Compensation Committee. The Board as a whole makes decisions related to compensation.

Corporate Governance and Nominating Committee

The Company does not have a corporate governance and nominating committee. The Board as a whole acts as the corporate governance and nominating committee.

Director Compensation Agreements

Except as described below, there are no service contracts of any of our directors and there is no arrangement or agreement made or proposed to be made between us and any of our directors pursuant to which a payment or other benefit is to be made or given by way of compensation in the event of that officer’s resignation, retirement or other termination of employment, or in the event of a change of control of us or a change in the director’s responsibilities following such change in control.

The Chief Executive Officer is to receive two times his then annual salary instead of termination pay if there is a change in control of the Company, by way of sale, lease, merger or transfer.

Compensation of Directors

There is no additional compensation to directors planned for 2014.

OTHER GOVERNANCE MATTERS

The Role of the Board in Risk Oversight

The understanding, identification and management of risk are essential elements for the successful management of the Company.

Risk oversight begins with the Board and the Audit Committee. The Audit Committee is chaired by Gregory Sullivan and each of our two independent directors sits on the Audit Committee.

The Audit Committee reviews and discusses policies with respect to risk assessment and risk management. The Audit Committee also has oversight responsibility with respect to the integrity of our financial reporting process and systems of internal control regarding finance and accounting, as well as our financial statements.

At the management level, an internal audit provides reliable and timely information to the Board and management regarding our effectiveness in identifying and appropriately controlling risks.

We also have a comprehensive internal risk framework, which facilitates performance of risk oversight by the Board and the Audit Committee. Our risk management framework is designed to:

16

Code

The Company is aware of its corporate governance responsibilities and seeks to operate to the highest ethical standards. The Company's operations, Board of Directors and executive team has recently expanded in the past year and the Company intends to adopt a code of ethics in the coming year.

EXECUTIVE COMPENSATION

The following table sets forth compensation paid to each of the individuals who served as our Principal Executive Officers (the “named executive officers”) for the fiscal years ended November 30, 2013 and 2012.

During the fiscal years ended November 30, 2013 and 2012, the Board made grants of cash and grants of warrants to certain directors and executives, the value of such grants of warrants and cash are indicated in the compensation table below.

| Non-Equity | Non-Qualified | ||||||||

| Stock | Options | Incentive Plan | Deferred | ||||||

| Name and | Salary | Bonus | Awards | Awards | Compensation | Compensation | All Other | ||

| Principal Position | Year | $ | $ | $ | $ | $ | Earnings $ | Compensation $ | Total |

| Gregory Sullivan, | 2013 | - | - | - | - | - | - | 158,400 | 158,400(1) |

| CEO | 2012 | - | - | - | 50,074 | - | - | 144,000 | 194,074(1) |

| Rakesh Malhotra, | 2013 | - | - | - | - | - | - | 58,530 | 58,530(2) |

| CFO | 2012 | - | - | - | 2,504 | - | - | 35,300 | 37,804(2) |

| Dean Thrasher, | 2013 | - | - | - | - | - | - | 120,000 | 120,000(3) |

| COO | 2012 | - | - | - | 50,074 | - | - | 120,000 | 170,074(3) |

| Allen Ezer, | 2013 | - | - | - | - | - | - | 100,500 | 100,500(4) |

| Executive Vice-President | 2012 | - | - | - | 106,309 | - | - | 77,000 | 183,309(4) - |

| Boaz Dor, | 2013 | - | - | - | - | - | - | 45,000 | 45,000(5) |

| Director | 2012 | - | - | - | 15,648 | - | - | 58,000 | 73,648(5) |

| (1) |

In 2013, $158,400 was paid in cash for services rendered. For 2012, $144,000 was paid in cash for services rendered. |

| (2) |

In 2013, $58,530 was paid in cash for services rendered. For 2012, $35,300 was paid in cash for services rendered. |

| (3) |

In 2013, $120,000 was paid in cash for services rendered. For 2012, $120,000 was paid in cash for services rendered. |

| (4) |

In 2013, $100,500 was paid in cash for services rendered. For 2012, $77,000 was paid in cash for services rendered. |

| (5) |

In 2013, $45,000 was paid in cash for services rendered. For 2012, $58,000 was paid in cash for services rendered. Boaz Dor resigned in year 2013 |

Executive Compensation Agreements

We are a party to an employment contract with Gregory Sullivan for three remaining years, a consulting agreement with; Allen Ezer for one year, and Dean Thrasher for one year with renewal features at the expiry dates. The renewals are not automatic. Pursuant to the agreements, Gregory Sullivan and Dean Thrasher are entitled to compensation for termination of their contracts in certain circumstances, including termination without cause and change of control. The contracted agreements provide for the payment of compensation that will be triggered by a termination of the executive officer’s employment by either us or the executive officer following a change of control of us, or by us at any time, other than for “cause.”

1. The Company has entered into an employment agreement with Gregory Sullivan, dated November 21, 2011, the Company’s Chief Executive Officer for a 5-year term commencing January 1, 2012. Mr. Sullivan’s remuneration is $12,000 per month with a 5% annual increase, and a $600 per month car allowance. The agreement has the following terms.

17

| (a) |

The agreement will automatically renew upon the expiry of each one-year term of the agreement, unless otherwise terminated in accordance with the agreement. |

|

| (b) |

The employment agreement may be terminated with mutual consent or Mr. Sullivan giving 3 weeks notice. |

|

| (c) |

The Company may terminate the agreement without any notice or pay in lieu of notice, if Mr. Sullivan breaches his employment agreement or the Company otherwise has just cause to terminate his employment; |

|

| (d) |

If Mr. Sullivan has not breached his employment contract or the Company does not have just cause to end his employment upon termination of his employment contract, the Company shall provide Mr. Sullivan with two- and-a-half times his then annual remuneration and by continuing his then benefits coverage for a period of two-and-a-half years. If a change in control of the Company occurs, the Company shall pay Mr. Sullivan two times his then remuneration. |

2. The Company has entered into a consulting agreement effective January 1, 2013 for a two-year period with Lumina Global Partners Inc. (“Lumina”), Lumina is a corporation controlled by Allen Ezer. Lumina’s remuneration is $8,500 per month, with a 5% increase on the first anniversary date. The agreement has the following terms.

| (a) |

The agreement shall be terminated once all services have been completed by Lumina. |

|

| (b) |

Either party may terminate the consulting agreement with 30 days written notice. |

|

| (c) |

All services provided by Lumina shall be invoiced up to the termination date. |

3. The Company has entered into a consulting agreement effective October 4, 2012 with Level 4 Capital Corp. (“L4”), and ending September 30, 2014. L4’s remuneration is $20,000 per month. At the discretion of L4, it may take remuneration in the form of cash or in Common Shares at a price of $0.45 per share. L4 is a corporation 50% owned by Dean Thrasher. The agreement has the following terms.

| (a) |

The agreement shall be terminated once all services have been completed by L4. Services include; guiding the Company’s manufacturer through all new product development, completing a public offering with securities commissions in Canada and the US, working with US and Canadian counsel in all aspects, go to market strategy, budgeting, and logistics of the products. |

|

| (b) |

Upon a change in control of L4, the Company has the right to terminate this agreement with 90 days notice. If a change of control of the Company occurs, the Company must pay L4 twenty-four months of fees. |

18

| (c) |

Either party may terminate the consulting agreement with mutual written consent. | |

| (d) |

All services provided by L4 shall be invoiced up to the termination date. |

Except as described above, there are no service contracts of any of officers and there is no arrangement or agreement made or proposed to be made between us and any of our named executive officers pursuant to which a payment or other benefit is to be made or given by way of compensation in the event of that officer’s resignation, retirement or other termination of employment, or in the event of a change of control of us or a change in the named executive officer’s responsibilities following such change in control.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth the stock options and stock appreciation rights granted to our named executive officers and directors, as of the fiscal year ended November 30, 2013.

| Option/Warrant Awards | Stock Awards | ||||||||

| Name

|

Number

of securities underlying unexercised options/ warrants (#)

exercisable |

Number of securities

underlying unexercised options/

warrants (#) unexercisable |

Equity

incentive plan awards: Number of

securities underlying unexercised

unearned options (#) |

Option/

Warrant exercise price ($) |

Option/ Warrant expiration date |

Number of shares

or units of stock that have not vested (#) |

Market value of

shares or units of stock

that have not vested ($) |

Equity

incentive plan awards: Number of

unearned shares, units or other rights

that have not vested (#) |

Equity incentive plan

awards: Market or payout value of

unearned shares, units or others rights

that have not vested ($) |

| Gregory | 897,000(1) | - | - | 0.13 – 0.50 | Oct. 2014 – Jan. | - | - | - | - |

| Sullivan, | 2016 | ||||||||

| CEO | |||||||||

| Rakesh | 320,000(2) | - | - | 0.13 - 0.25 | June 2014 – | - | - | - | - |

| Malhotra, | Jan. 2016 | ||||||||

| CFO and | |||||||||

| Treasurer | |||||||||

| Dean | 400,000(3) | - | - | 0.13 | Jan. 2016 | - | - | - | - |

| Thrasher, | |||||||||

| COO | |||||||||

| Allen Ezer | 650,000(4) | - | - | 0.13 – 0.20 | Jan. 2016 – | - | - | - | - |

| Executive | Aug. 2016 | ||||||||

| Vice- | |||||||||

| President | |||||||||

| Duane | 1,000,000(6) | - | - | 0.45 | Oct 25, 2016 | - | - | - | - |

| Parnham, | |||||||||

| Director | |||||||||

| David | 100,000(7) | - | - | 0.45 | Oct 25, 2016 | - | - | - | - |

| Goodbrand, | |||||||||

| Director | |||||||||

| (1) |

Mr. Sullivan holds 897,000 warrants. The strike price of Mr. Sullivan’s warrants range from $0.13 to $0.50, with expiry dates from October 5, 2014 to January 4, 2016. |

19

| (2) |

Mr. Malhotra holds 125,000 options with a strike price of $0.25 and an expiry date of June 30, 2014. Mr. Malhotra also holds 195,000 warrants with a strike price ranging from $0.13 - $0.20 and expiry dates ranging from January 10, 2015 to January 4, 2016. |

| (3) |

Level 4 Capital Corp., a company Dean Thrasher is the 50% beneficial owner of holds 800,000 warrants with a strike price of $0.13, expiring on January 4, 2016. Mr. Thrasher beneficially owns 400,000 of these warrants. |

| (4) |

Mr. Ezer holds 650,000 warrants through a company he owns (Lumina Global Partners Inc.). These warrants are valued at November 30, 2013. The strike price of Mr. Ezer’s warrants range from $0.13 to $0.20, with expiry dates from January 4, 2016 to August 9, 2016. |

| (5) |

Mr. Parnham hold 1,000,000 stock options, 1,000,000 have vested as at November 30, 2013. The strike price of Mr. Parnham’s option is $0.45, with an expiry date of October 25, 2016. |

| (6) |

Mr. Goodbrand holds 100,000 stock options, 100,000 have vested as at November 30, 2013. The strike price of Mr. Goodbrand’s option is $0.45, with an expiry date of October 25, 2016. |

Retirement, Resignation or Termination Plans-

We do not sponsor any plans, that would provide compensation or benefits of any type to an executive upon retirement, or any plans that would provide payment for retirement, resignation, or termination as a result of a change in control of our Company or as a result of a change in the responsibilities of an executive following a change in control of our Company, provided however that as described above each of Gregory Sullivan and Dean Thrasher that provide, in each case, for the payment of twenty four (24) months of annual salary or fees upon termination as a result of change in control of our Company. Mr. Thrasher, through a company he has an interest in, (Level 4 Capital Corp.) is a party to an agreement with SDI to be the Company’s COO.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

The following tables set forth information as of March 26, 2014 regarding the ownership of our common stock by:

The number of shares beneficially owned and the percentage of shares beneficially owned are based on shares of common stock outstanding as of March 26, 2014.

For the purposes of the information provided below, shares subject to options and warrants that are exercisable within 60 days following March 26, 2014 are deemed to be outstanding and beneficially owned by the holder for the purpose of computing the number of shares and percentage ownership of that holder but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. Except as indicated in the footnotes to these tables, and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them.

Principal Stockholders

| Title of Class | Name of Beneficial Owner(1) | Address of

Beneficial Owner(1) |

Amount and

Nature of Beneficial Ownership Shares |

Percent of Class |

| Common Stock, Warrants |

Alpha North Asset Management | Toronto, Ontario Canada |

4,974,378 (2) | 10.6% |

| Common Stock, Warrants | Level 4 Capital Corp. | Oakville, Ontario Canada | 2,600,000(3) | 5.55% |

20

| (1) |

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to shares. Unless otherwise indicated, the persons named in this table have sole voting and sole investment control with respect to all shares beneficially owned. Figures shown are on a non-diluted basis. |

| (2) |

Includes warrants exercisable to acquire 275,000 shares of common stock for a 24-month period. |

| (3) |

Includes warrants exercisable to acquire 800,000 shares of common stock. Mr. Thrasher, the Company’s Chief Operating Officer does not control Level 4 Capital Corp., but is a 50% beneficial owner. |

Security Ownership of Management

| Title of Class | Name of Beneficial Owner(1) | Address of Beneficial Owner(1) | Amount and Nature of

Beneficial Ownership Shares |

Percent of Class |

| Common Stock, Warrants |

Gregory Sullivan, Chief Executive

Officer and Director |

Burlington, Ontario Canada |

1,867,000 (2) | 3.98% |

| Options, Warrants |

Rakesh Malhotra, Treasurer and Chief Financial Officer |

Mississauga, Ontario Canada |

320,000 (3) | 0.68% |

| Common Stock, Warrants |

Dean Thrasher, Chief Operating Officer | Burlington, Ontario Canada |

1,300,000 (4) | 2.77% |

| Common Stock, Warrants |

Allen Ezer, Executive Vice- President |

Mississauga, Ontario Canada |

710,000 (5) | 1.51% |

| Common Stock, Options |

Duane Parnham, Director | Oakville, Ontario Canada |

1,525,000 (6) | 3.26% |

| Option | David Goodbrand, Director | Shanty Bay, Ontario Canada |

100,000 (7) | 0.21% |

| Common Stock | Keith Morrison, Director (Nominee) |

Oakville, Ontario Canada |

214,118 | 0.46% |

| Total for Officers and Directors | 6,436,118 | 12.87% |

21

|

(1) |

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to shares. Unless otherwise indicated, the persons named in this table have sole voting and sole investment control with respect to all shares beneficially owned. | |

| (2) | Includes warrants exercisable to acquire 897,000 shares of common stock. | |

| (3) | Includes vested options exercisable to acquire 125,000 shares of common stock, and 195,000 warrants. | |

|

(4) |

Includes warrants exercisable to acquire 400,000 shares of common stock. These securities are in the name of Level 4 Capital Corp. Mr. Thrasher does not control Level 4 Capital Corp., but is a 50% beneficial owner. | |

| (5) | Includes warrants exercisable to acquire 650,000 shares of common stock. | |

| (6) | Includes vested options exercisable to acquire 1,000,000 shares of common stock | |

| (7) | Includes vested options exercisable to acquire 100,000 shares of common stock |

We have no knowledge of any arrangements, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change in our control.

We are not, to the best of our knowledge, directly or indirectly owned or controlled by another corporation or foreign government.

As of March 26, 2014, we had approximately 71 stockholders of record listed on our stock ledger.

INTEREST OF CERTAIN PERSONS AND CORPORATIONS IN MATTERS TO BE ACTED UPON

Other than each director's and officer's interest in the Company's Stock Option Plan, no person who has been a director or executive officer of the Company since the beginning of the last financial year and no associate or affiliate of any such director or executive officer has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Except for the transactions described below, none of our directors, senior officers or principal stockholders, nor any associate or affiliate of the foregoing have any interest, direct or indirect, in any transaction, since the beginning of the fiscal year ended November 30, 2013, or in any proposed transactions, in which such person had or is to have a direct or indirect material interest.

Related party transactions are reviewed and approved by the Board.

Purchases of Securities

During and subsequent to the fiscal year ending November 30, 2013, our officers, directors and 10% stockholders purchased our securities on the following terms:

| Officer, Director, 10%

Stockholder |

Type of Security | Amount | Price of Security | Date of Purchase |

| Alpha North Asset Management | Common shares | $(1) | $ (1) | (1) |

| Gregory Sullivan | Common Shares | $30,000 | $0.30 | August 30, 2012 |

| (1) |

On January 30, 2013, the Company issued a $199,342 (CAD $200,000) 6% convertible bridge loan with a term to July 30, 2013 (the “Maturity Date”). The holder has the option at any time prior to the maturity date to demand the payment of principal and interest (the “Demand Date”). Therefore, the principal amount of the note and interest is payable at the earlier of the demand date or the maturity date. In the event the holder demands payment, the Company has ten days to make payment. In the event the Company does not make payment within the ten day period, the holder has the option to convert the outstanding principal, interest, and top-up mechanism into common stock. The conversion price of the note is equal to the twenty day moving average of the trading market price on the date of conversion (“variable conversion price”). The holder is entitled to the maximum allowable discount. As a top-up mechanism, on or before the maturity date, the Company is required to pay the holder $11,961. On September 16, 2013, the holder converted the bridge loan ($199,342), accrued interest ($7,504), and top-up mechanism ($11,961) totaling $218,807 into 736,078 shares of common stock. |

22

|

On May 14, 2013, the Company issued a $147,812 (CAD $150,000) 6% convertible bridge loan with a term to July 30, 2013 (the “Maturity Date”). The holder has the option at any time prior to the maturity date to demand the payment of principal and interest (the “Demand Date”). Therefore, the principal amount of the note and interest is payable at the earlier of the demand date or the maturity date. In the event the holder demands payment, the Company has ten days to make payment. In the event the Company does not make payment within the ten day period, the holder has the option to convert the outstanding principal, interest, and top-up mechanism into common stock. The conversion price of the note is equal to the twenty day moving average of the trading market price on the date of conversion (“variable conversion price”). The holder is entitled to the maximum allowable discount. As a top-up mechanism, on or before the maturity date, the Company is required to pay the holder $8,869. On September 16, 2013, the holder converted the bridge loan ($147,812), accrued interest ($3,037), and top- up mechanism ($8,869) totaling $159,718 into 537,300 shares of common stock. |

|

| (2) |

Other than compensatory arrangements described under “Executive Compensation” and the transactions described above, we have had no other transactions, directly or indirectly, during the past fiscal year with our directors, senior officers or principal stockholders, or any of their associates or affiliates in which they had or have a direct or indirect material interest. |

PROPOSAL 2 — RATIFICATION OF

THE APPOINTMENT OF THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

What am I voting on?

The Audit Committee has selected Schwartz, Levitsky, Feldman, LLP to be its Independent Registered Public Accounting Firm for the current fiscal year ending November 30, 2014.

This proposal seeks stockholder ratification of the appointment of Schwartz, Levitsky, Feldman, LLP.

INFORMATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Schwartz, Levitsky, Feldman, LLP was the Independent Registered Public Accounting Firm for us in the fiscal year ended November 30, 2013 and 2012.

If a representative of Schwartz, Levitsky, Feldman, LLP does attend the Annual Meeting, they will be given an opportunity to make a statement, should they choose to do so. We do not know if the representative, if one does attend the Annual Meeting, would make himself or herself available for questions at the Annual Meeting.

Audit FeesThe aggregate fees billed by our auditors for professional services rendered in connection with the audit of our annual consolidated financial statements for fiscal 2013 and 2012 and reviews of the consolidated financial statements included in our Forms 10-K and 10-Q for fiscal 2013 and 2012 were $36,500 and $36,500, respectively.

Audit-Related Fees

The aggregate fees billed by our independent registered public accounting firm for any additional fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees” above for 2013 and 2012 were $0.

23

Tax Fees

The aggregate fees billed by our auditors for professional services for tax compliance, tax advice, and tax planning for fiscal 2013 and 2012 were $0 and $0, respectively.

All Other Fees

The aggregate fees billed by our auditors for all other non-audit services rendered to us, for fiscal 2013 and 2012 were $24,000 and $0, respectively. All other fees for 2013 represent amounts billed for services relating to filing of prospectus/S-1 in Canada and USA.

The Audit Committee does not have any formal pre-approval policies and procedures for non-audit services undertaken by the registered public accounting firm.

The Board recommends a vote FOR the ratification of the appointment of the independent registered public accounting firm. All proxies executed and returned without an indication of how shares of common stock should be voted will be voted FOR the appointment of the independent registered public accounting firm.

24

PROPOSAL 3 — APPROVAL OF THE INCENTIVE STOCK OPTION PLAN

You are being asked to vote for the Incentive Stock Option Plan which is described in greater detail below.

The shareholders of the Company are being asked to consider, and if thought fit, to pass the following resolution:

"BE IT RESOLVED THAT the incentive stock option plan of the Company is hereby approved and confirmed."

Overview of the Company’s Stock Option Plans

Effective October 30, 2006, SDI adopted the following stock option and stock bonus plans which were replaced by the Incentive Stock Option Plan (the “2013 Plan”) in May 2013.

Non-Qualified Stock Option Plan. SDI’s Non-Qualified Stock Option Plan authorizes the issuance of shares of SDI’s Common Stock to persons that exercise options granted pursuant to the Plans. SDI’s employees, directors, officers, consultants and advisors are eligible to be granted options pursuant to the Plans, provided however that bona fide services must be rendered by such consultants or advisors and such services must not be in connection with the offer or sale of securities in a capital-raising transaction.

Incentive Stock Option Plan. SDI’s Incentive Stock Option Plan authorizes the issuance of shares of SDI’s Common Stock to persons that exercise options granted pursuant to the Plan. Only SDI employees may be granted options pursuant to the Incentive Stock Option Plan. The option exercise price is determined by SDI’s directors but cannot be less than the market price of SDI’s common stock on the date the option is granted. There are no options currently outstanding under Incentive Stock Option Plan. No options have been issued under this plan as at November 30, 2013.

Stock Bonus Plan. SDI’s Stock Bonus Plan allows for the issuance of shares of common stock to its employees, directors, officers, consultants and advisors. However bona fide services must be rendered by the consultants or advisors and such services must not be in connection with the offer or sale of securities in a capital-raising transaction. No options have been issued under this plan as at November 30, 2013.

On October 10, 2007, our Board adopted the Non-Qualified Stock Option Plan for 4,500,000 shares to be issued. As of March 26, 2014, there are 1,510,000 options outstanding.

On April 10, 2008, our Board amended the Non-Qualified Stock Option Plan to permit 5,000,000 shares to be issued. Effective May 31, 2013, the Company adopted the 2013 Plan, which replaces the stock option and stock bonus plans that were in place prior to adoption of the 2013 Plan. All outstanding options to purchase shares of common stock granted by the Company under the prior plans are now governed by the 2013 Plan and the prior plans (an Incentive Stock Option Plan, a Non-Qualified Stock Option Plan, and a Stock Bonus Plan) have been terminated. A full copy of the 2013 Plan is attached hereto as Appendix “A”.

We have not granted any options, which are subject to ratification by stockholders. The table below shows securities issued under our equity compensation plans as of November 30, 2013.

25

| Number of

securities to be issued upon exercise of outstanding options, warrants, and rights (a) |

Weighted-average exercise price of outstanding options, |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) | |

| Equity compensation plans approved by security holders(1) | 7,052,645(1) | $0.23 | 2,317,212(2) |

| Equity compensation plans not approved by security holders | -- | -- | |

| TOTAL | 7,052,645 | 2,317,212 |

(1) Consists of 1,510,000 outstanding options granted from the Non-Qualified Stock Option Plan, and 5,542,645 warrants. Included in this figure are 898,645 broker warrants granted for the IPO in Canada.

(2) Consists of 2,317,212 options from the 2013 Plan.

Overview of the 2013 Plan

Effective May 31, 2013, the board of directors adopted 2013 Plan, which replaces the stock option and stock bonus plans that were in place prior to adoption of the 2013 Plan. All outstanding options to purchase common shares granted by the Company under the prior plans are now governed by the 2013 Plan and the prior plans (an Incentive Stock Option Plan, a Non-Qualified Stock Option Plan, and a Stock Bonus Plan) have been terminated.

The 2013 Plan is subject to approval by the Company’s shareholders, which approval will be sought at the Meeting. Options outstanding under the 2013 Plan cannot be exercised until the 2013 Plan has been approved by both the TSXV and the shareholders.

As a condition precedent to the TSXV issuing its final acceptance of listing of the common shares on the TSXV, all of the warrants previously issued by the Company in satisfaction of remuneration for services (the “Compensation Warrants”), being warrants to purchase 4,319,000 common shares, are included under the 2013 Plan reserve and reduce the number of options which may otherwise be granted.

The 2013 Plan authorizes the issuance of that number of common shares which is equal to 20% of the issued and outstanding common shares following completion of the offering (the “Offering”) under the Company’s prospectus dated July 2, 2013 filed with the securities regulatory authorities in the provinces of Ontario, British Columbia and Alberta and conversion prior to listing of the convertible debentures outstanding upon completion of the Offering. Accordingly, the 2013 Plan reserved for issuance 9,369,857 common shares on exercise of options to be granted under the 2013 Plan, on exercise of options granted under the prior plans (which are now governed by the 2013 Plan), and on exercise of the Compensation Warrants.

The material terms of the 2013 Plan are as follows:

| 1. |

The board of directors administers the 2013 Plan. |

26

| 2. |

The employees, directors, officers and consultants of the Company, and employees of a management services provider to the Company, are eligible to be granted options pursuant to 2013 Plan. |

| 3. |

The term of any option granted under the Plan will be fixed by the board of directors at the time such option is granted, provided that options will not be permitted to exceed a term of 10 years. |

The exercise price of any options granted under the Plan will be determined by the board of directors, in its sole discretion, but shall not be less than the last closing price of the common shares prior to the grant of the option.

No vesting requirements will apply to options granted under the 2013 Plan, unless otherwise determined by the board of directors. Options granted to persons retained to provide investor relations activities must vest in stages over a period of not less than 12 months, with not more than 1/4 of the options vesting in any three month period.

All options will be non-assignable and non-transferable.

The aggregate number of options granted in a 12 month period (a) to any one person (and companies wholly owned by that person) must not exceed 5% of the common shares, (b) to all persons retained to provide investor relations activities must not exceed 2% of the common shares, and (c) to any one consultant must not exceed 5% of the common shares.

If the option holder ceases to be an eligible person under the 2013 Plan, then the holder’s option shall expire on the earlier of (a) 90 days after the date that the option holder ceases to be an eligible person (unless the board had fixed a period of more than 90 days, but not exceeding one year, at the time the option was granted), and (b) the expiry date of the option. Disinterested shareholder approval must be obtained for (i) any reduction in the exercise price of an outstanding option, if the option holder is an insider; and (ii) any grant of options to any one individual, within a 12 month period, exceeding 5% of the Company’s issued shares.

The expiry date of an option will be automatically extended if the expiry date falls within a blackout period imposed by the Company under to its internal trading policies as a result of the existence of undisclosed material information. The extension will be until 5:00 p.m. on the day which follows the expiry of the blackout period by the lesser of 10 business days and the number of business days within the blackout period.

Options will be adjusted in the event of any consolidation, subdivision, conversion or exchange of the Company’s subordinate voting securities.

The TSXV requires that the Company obtain shareholder approval of the 2013 Plan because the amended Plan could resulted at any time in the number of common shares reserved for issuance under options exceeding 10% of the issued shares.

The TSXV also requires that the Company obtain disinterested shareholder approval of the 2013 Plan because the 2013 Plan could result at any time in: (i) the number of common shares reserved for issuance to insiders (as a group) exceeding 10% of the issued shares, or (ii) the grant to insiders (as a group), within a 12 month period, of a number of options exceeding 10% of the issued shares. Disinterested shareholder approval is the approval of a majority of the votes cast by all shareholders voting at the Meeting (in person or by proxy) excluding votes attached to common shares beneficially owned by (a) insiders to whom options may be granted under the 2013 Plan, or (b) associates of insiders to whom options may be granted under the 2013 Plan. The votes attached to 1,800,000 common shares will be excluded from voting for purposes of obtaining disinterested shareholder approval.

Who is eligible to participate in the Company’s 2013 Plan?

Any employee, officer, director, consultant, independent contractor, or director of or providing services to us or any parent, affiliate, or subsidiary of us is eligible to be designated a participant in the 2013 Plan.

Currently, this includes, but is not limited to, the following directors and executives:

27

Gregory Sullivan, Chief Executive Officer, Director

Rakesh Malhotra, Chief Financial Officer

Dean Thrasher, Chief Operating Officer

Allen Ezer, Executive Vice-President, Director

Duane Parnham, Director

David Goodbrand, Director

In total there are approximately 10 officers, directors, employees, and consultants eligible under the 2013 Plan.

What benefit amounts will be received under the 2013 Plan?

Currently, the Board has not authorized the issuance of options covered by the share increase. The following is a summary of the current options issued under our 2013 Plan, to current officers and directors:

| Directors & Officers | Number of options granted | Number of vested options |

| Rakesh Malhotra | 125,000 | 125,000 |

| Duane Parnham | 1,000,000 | 1,000,000 |

| David Goodbrand | 100,000 | 100,000 |

The Board recommends a vote FOR the approval of the 2013 Plan. All proxies executed and returned without an indication of how shares of common stock should be voted will be voted FOR the approval of the 2013 Plan.

28

OTHER MATTERS

As of the date of this Proxy Statement, management does not know of any other matter that will come before the Annual Meeting.

By: Order of the Board of Directors,

/s/ Dean Thrasher

Secretary

March 26, 2014

29

Appendix “A”

STOCK OPTION PLAN