UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended August 31, 2016

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number: 333-132456

SECURITY DEVICES INTERNATIONAL,

INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware |

71-1050654 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

25 Sawyer Passway, Fitchburg

Massachusetts,

01420

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number including area code: (905) 582-6402

N/A

Former name, former address,

and former fiscal year, if changed since last report

Indicate by check mark whether the registrant (1) filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the past 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Larger accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

As of September 30, 2016, the Company had 55,104,493 issued and outstanding shares of common stock.

SECURITY DEVICES INTERNATIONAL, INC.

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AUGUST 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

SECURITY DEVICES INTERNATIONAL, INC.

INTERIM

FINANCIAL STATEMENTS

AUGUST 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

TABLE OF CONTENTS

SECURITY DEVICES INTERNATIONAL, INC.

Interim

Consolidated Balance Sheets

As at August 31, 2016 and November 30,

2015

(Amounts expressed in US Dollars)

| August 31, | November 30, | |||||

| 2016 | 2015 | |||||

| (unaudited) | (audited) | |||||

| $ | $ | |||||

| ASSETS | ||||||

| CURRENT | ||||||

| Cash and cash equivalent | 488,224 | 1,851,021 | ||||

| Accounts Receivable | 14,874 | 39,676 | ||||

| Inventory (Note 10) | 16,984 | 44,319 | ||||

| Deferred financing costs (Note 9) | 59,216 | 63,741 | ||||

| Prepaid expenses and other receivables | 83,623 | 27,283 | ||||

| Total Current Assets | 662,921 | 2,026,040 | ||||

| Deferred financing costs (Note 9) | - | 43,367 | ||||

| Property and Equipment (Note 3) | 62,124 | 97,011 | ||||

| TOTAL ASSETS | 725,045 | 2,166,418 | ||||

| LIABILITIES | ||||||

| CURRENT LIABILITIES | ||||||

| Accounts payable and accrued liabilities | 82,468 | 173,329 | ||||

| Convertible Debentures (Note 9) | 1,398,592 | - | ||||

| Total Current Liabilities | 1,481,060 | 173,329 | ||||

| Convertible Debentures (Note 9) | - | 1,398,592 | ||||

| Total Liabilities | 1,481,060 | 1,571,921 | ||||

| Going Concern (Note 2) | ||||||

| Related Party Transactions (Note 6) | ||||||

| Commitments (Note 7) | ||||||

| Segment Disclosures (Note 11) | ||||||

| Subsequent Events (Note 12) | ||||||

| STOCKHOLDERS' EQUITY (DEFICIENCY) | ||||||

| Capital Stock (Note 4) | ||||||

| Preferred stock, $0.001 par value,

5,000,000 shares authorized, Nil issued and

outstanding (2015 - nil). Common stock, $0.001 par value 100,000,000 shares authorized (2015: 100,000,000), 54,615,642 issued and outstanding (2015: 54,615,642) |

54,616 |

54,616 |

||||

| Additional Paid-In Capital | 27,182,401 | 27,179,827 | ||||

| Deficiency | (27,937,161 | ) | (26,593,207 | ) | ||

| Accumulated other comprehensive loss | (55,871 | ) | (46,739 | ) | ||

| Total Stockholders' Equity (Deficiency) | (756,015 | ) | 594,497 | |||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) | 725,045 | 2,166,418 |

See condensed notes to the interim consolidated financial statements.

1

SECURITY DEVICES INTERNATIONAL, INC.

Interim Consolidated

Statements of Operations and Comprehensive loss

For the Nine months

and Three Months Ended August 31, 2016 and August 31, 2015

(Amounts

expressed in US Dollars)

(Unaudited)

|

|

For the | For the | For the | For the | ||||||||

|

|

nine | nine | three | three | ||||||||

|

|

months | months | months | months | ||||||||

|

|

ended | ended | ended | ended | ||||||||

|

|

August 31, | August 31, | August 31, | August 31, | ||||||||

|

|

2016 | 2015 | 2016 | 2015 | ||||||||

|

|

$ | $ | $ | $ | ||||||||

|

|

||||||||||||

|

SALES |

82,849 | 85,362 | 30,627 | 10,757 | ||||||||

|

COST OF SALES |

(51,021 | ) | (65,048 | ) | (18,684 | ) | (5,480 | ) | ||||

|

GROSS PROFIT |

31,828 | 20,314 | 11,943 | 5,277 | ||||||||

|

|

||||||||||||

|

EXPENSES: |

||||||||||||

|

Depreciation |

34,886 | 35,374 | 11,628 | 11,791 | ||||||||

|

General and administration |

1,166,555 | 1,236,246 | 433,918 | 402,699 | ||||||||

|

TOTAL OPERATING EXPENSES |

1,201,441 | 1,271,620 | 445,546 | 414,490 | ||||||||

|

LOSS FROM OPERATIONS |

(1,169,613 | ) | (1,251,306 | ) | (433,603 | ) | (409,213 | ) | ||||

|

Other expense- Interest (Note 9) |

(174,341 | ) | (173,707 | ) | (58,325 | ) | (58,325 | ) | ||||

|

LOSS BEFORE INCOME TAXES |

(1,343,954 | ) | (1,425,013 | ) | (491,928 | ) | (467,538 | ) | ||||

|

Income taxes |

- | - | - | - | ||||||||

|

NET LOSS |

(1,343,954 | ) | (1,425,013 | ) | (491,928 | ) | (467,538 | ) | ||||

|

Foreign exchange translation adjustment for the period |

(9,132 | ) | (9,135 | ) | (1,302 | ) | (2,295 | ) | ||||

|

COMPREHENSIVE LOSS |

(1,353,086 | ) | (1,434,148 | ) | (493,230 | ) | (469,833 | ) | ||||

|

Loss per share - basic and diluted |

(0.02 | ) | (0.03 | ) | (0.01 | ) | (0.01 | ) | ||||

|

Weighted average number of common shares outstanding |

54,615,642 | 48,992,501 | 54,615,642 | 53,133,429 |

See condensed notes to the interim consolidated financial statements.

2

SECURITY DEVICES INTERNATIONAL, INC.

Interim

Consolidated Statements of Cash Flows

For the Nine Months Ended August

31, 2016 and August 31, 2015

(Amounts expressed in US

Dollars)

(Unaudited)

|

|

For the | For the | ||||

|

|

nine | nine | ||||

|

|

months | months | ||||

|

|

ended | ended | ||||

|

|

August 31, | August 31, | ||||

|

|

2016 | 2015 | ||||

|

|

$ | $ | ||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

||||||

|

|

||||||

|

Net loss for the period |

(1,343,954 | ) | (1,425,013 | ) | ||

|

Items not requiring an outlay of cash: |

||||||

|

Amortization of deferred financing costs |

47,892 | 47,718 | ||||

|

Depreciation |

34,886 | 35,374 | ||||

|

Stock based compensation |

2,574 | - | ||||

|

Changes in non-cash working capital: |

||||||

|

Accounts receivable |

22,944 | (8,939 | ) | |||

|

Prepaid expenses and other receivables |

(55,434 | ) | (27,025 | ) | ||

|

Inventory |

27,335 | 51,318 | ||||

|

Accounts payable and accrued liabilities |

(83,764 | ) | (91,117 | ) | ||

|

|

||||||

|

NET CASH USED IN OPERATING ACTIVITIES |

(1,347,521 | ) | (1,417,684 | ) | ||

|

|

||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES |

||||||

|

Acquisition of equipment |

- | - | ||||

|

|

||||||

|

NET CASH USED IN INVESTING ACTIVITIES |

- | - | ||||

|

|

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

||||||

|

Issue of common stock |

2,500,000 | |||||

|

Exercise of stock options and/or warrants |

- | 23,770 | ||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES |

- | 2,523,770 | ||||

|

Effects of foreign currency exchange rate changes |

(15,276 | ) | (30,144 | ) | ||

|

NET DECREASE IN CASH AND CASH EQUIVALENT FOR THE PERIOD |

(1,362,797 | ) | 1,075,942 | |||

|

Cash and cash equivalent, beginning of period |

1,851,021 | 1,085,006 | ||||

|

CASH AND CASH EQUIVALENT, END OF PERIOD |

488,224 | 2,160,948 | ||||

|

|

||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOWS: |

||||||

|

|

||||||

|

INCOME TAXES PAID |

- | - | ||||

|

|

||||||

|

INTEREST PAID |

161,372 | 167,831 |

See condensed notes to the interim consolidated financial statements.

3

SECURITY DEVICES INTERNATIONAL, INC.

Interim

Consolidated Statement of Changes in Stockholders’ Equity (Deficiency)

(Amounts expressed in US Dollars)

(Unaudited)

|

|

Accumulated | |||||||||||||||||

|

|

Number of Common | Additional | Other | |||||||||||||||

|

|

Common | Shares | Paid-in | Comprehensive | ||||||||||||||

|

|

Shares | amount | Capital | Deficiency | loss | Total | ||||||||||||

|

|

$ | $ | $ | $ | $ | $ | ||||||||||||

|

|

||||||||||||||||||

|

Balance as of November 30, 2014 |

46,899,285 | 46,899 | 24,024,631 | (24,042,769 | ) | (31,706 | ) | (2,945 | ) | |||||||||

|

Issue of common shares |

7,575,757 | 7,576 | 2,492,424 | 2,500,000 | ||||||||||||||

|

Exercise of options |

35,000 | 35 | 6,960 | 6,995 | ||||||||||||||

|

Exercise of warrants |

105,600 | 106 | 16,669 | 16,775 | ||||||||||||||

|

Stock based compensation for issue of options |

422,459 | 422,459 | ||||||||||||||||

|

Stock based compensation for modification of warrants |

216,684 | 216,684 | ||||||||||||||||

|

Net loss for the year |

(2,550,438 | ) | (2,550,438 | ) | ||||||||||||||

|

Foreign currency translation |

(15,033 | ) | (15,033 | ) | ||||||||||||||

|

Balance as of November 30, 2015 |

54,615,642 | 54,616 | 27,179,827 | (26,593,207 | ) | (46,739 | ) | 594,497 | ||||||||||

|

Stock based compensation |

2,574 | 2,574 | ||||||||||||||||

|

Net loss for the period |

(1,343,954 | ) | (1,343,954 | ) | ||||||||||||||

|

Foreign currency translation |

(9,132 | ) | (9,132 | ) | ||||||||||||||

|

Balance as of August 31, 2016 |

54,615,642 | 54,616 | 27,182,401 | (27,937,161 | ) | (55,871 | ) | (756,015 | ) | |||||||||

See condensed notes to the interim consolidated financial statements.

4

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 1. |

BASIS OF PRESENTATION |

|

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and therefore do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with accounting principles generally accepted in the United States of America (GAAP); however, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for a fair presentation of the results for the interim periods. | |

|

The unaudited interim consolidated financial statements should be read in conjunction with the financial statements and notes thereto together with management’s discussion and analysis of financial condition and results of operations contained in Security Devices International Inc.’s (“SDI” or the “Company”) annual report on Form 10-K for the year ended November 30, 2015. In the opinion of management, the accompanying unaudited interim consolidated financial statements reflect all adjustments of a normal recurring nature considered necessary to fairly state the financial position of the Company at August 31, 2016 and November 30, 2015, the results of its operations for the nine and three-month periods ended August 31, 2016 and August 31, 2015, and its cash flows for the nine-month periods ended August 31, 2016 and August 31, 2015. In addition, some of the Company’s statements in this quarterly report on Form 10-Q may be considered forward-looking and involve risks and uncertainties that could significantly impact expected results. The results of operations for the nine-month period ended August 31, 2016 are not necessarily indicative of results to be expected for the full year. | |

|

The Company was incorporated under the laws of the state of Delaware on March 1, 2005. On February 3, 2014 the Company incorporated a wholly owned subsidiary in Canada “Security Devices International Canada Corp”. The interim unaudited consolidated financial statements for the period ended August 31, 2016 include the accounts of Security Devices International, Inc. (the “Company” or “SDI”), and its subsidiaries Security Devices International Canada Corp. and SDI-Sage Acquisition Inc. All material inter-company accounts and transactions have been eliminated. |

| 2. |

NATURE OF OPERATIONS AND GOING CONCERN |

|

The Company is a less-lethal defense technology company, specializing in the innovative next generation solutions for security situations that do not require the use of lethal force. SDI has implemented manufacturing partnerships to assist in the deployment of their patented and patent pending family of products. These products consist of the current manufacture of Blunt Impact Projectile 40mm (BIP) line of products, and the future Wireless Electric Projectile 40mm (WEP). | |

|

These unaudited interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. | |

|

The Company’s activities are subject to risk and uncertainties including- | |

|

The Company has not earned adequate revenue and has used cash in its operations. Therefore, the Company will need additional financing to continue its operations if it is unable to generate substantial revenue growth. | |

|

The Company has incurred a cumulative loss of $27,937,161 from inception to August 31, 2016. The Company has funded operations through the issuance of capital stock and convertible debentures. The Company has started to generate revenue from operations. However, it still expects to incur significant expenses before becoming profitable. The Company’s future success is dependent upon its ability to raise sufficient capital or generate adequate revenue, to cover its ongoing operating expenses, and also to continue to develop and be able to profitably market its products. These factors raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. |

5

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31,

2016

(Amounts expressed in US Dollars)

(Unaudited)

| 2. |

NATURE OF OPERATIONS AND GOING CONCERN -Cont’d |

|

In addition to raising funds in the prior years, the Company raised $878,328 by issue of Convertible Debentures during the year ended November 30, 2011 and $910,000 during the year ended November 30, 2012. In addition, the Company raised $649,750 by issuance of 2,165,834 common shares during the year ended November 30, 2012. On August 15, 2013, the Company filed an amended and restated final prospectus (the “Prospectus”) in Canada, in the provinces of Alberta, British Columbia and Ontario for listing its shares in these provinces in Canada. On August 27, 2013 the Company completed an initial public offering to raise gross proceeds of CAD $3,993,980 (US $3,794,280) through the issuance of 9,984,950 Common Shares at a price of CAD $0.40 (US $0.38) per Common Share (the “Issue Price”). During the year ended November 30, 2014, the Company issued $1,398,592 (CAD $1,549,000) face value 12% convertible debentures with a term to August 6, 2017 (the “Maturity Date”) and raised net $1,241,299. In 2015, the Company raised $2,500,000 through the issuance of 7,575,757 common shares and also issued 105,600 common shares on exercise of warrants for $16,775 and 35,000 common shares on exercise of options for $6,995. The Company’s common shares commenced trading on the TSX Venture Exchange (“TSX”) under the symbol “SDZ”. |

6

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 3. |

PROPERTY AND EQUIPMENT |

Property and equipment are recorded at cost less accumulated depreciation. Depreciation is provided commencing in the month following acquisition using the following annual rate and method:

| Computer equipment 30% | declining balance method |

| Furniture and Fixtures 30% | declining balance method |

| Leasehold Improvements | straight line over period of lease |

| Moulds 20% | straight line over 5 years |

| August 31, 2016 | November 30, 2015 | ||||||||||||

| Accumulated | Accumulated | ||||||||||||

| Cost | Amortization | Cost | Amortization | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Computer equipment | 37,573 | 35,178 | 37,573 | 34,483 | |||||||||

| Furniture and fixtures | 18,027 | 16,500 | 18,027 | 16,057 | |||||||||

| Leasehold Improvements | 23,721 | 18,565 | 23,721 | 16,244 | |||||||||

| Moulds | 209,515 | 156,469 | 209,515 | 125,041 | |||||||||

| 288,836 | 226,712 | 288,836 | 191,825 | ||||||||||

| Net carrying amount | $ | 62,124 | $ | 97,011 | |||||||||

| Depreciation expense | $ | 34,886 (6 months | ) | 47,165 (12 months) | |||||||||

| 4. |

CAPITAL STOCK |

| a) |

Authorized |

100,000,000* Common shares, $0.001 par value

And

5,000,000 Preferred shares, $0.001 par value

*On March 20, 2013 the Company filed with the Secretary of the State of Delaware a certificate of amendment (the “Amendment”) to the Company’s certificate of incorporation. The Amendment increased the number of authorized shares of the Company’s common stock, par value $0.001, from 50,000,000 to 100,000,000 common shares.

The Company’s Articles of Incorporation authorize its Board of Directors to issue up to 5,000,000 shares of preferred stock. The provisions in the Articles of Incorporation relating to the preferred stock allow the directors to issue preferred stock with multiple votes per share and dividend rights, which would have priority over any dividends paid with respect to the holders of SDI’s common stock.

| b) |

Issued | |

|

54,615,642 Common shares (November 30, 2015: 54,615,642 Common shares) |

7

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 4. |

CAPITAL STOCK-Cont’d |

| c) |

Changes to Issued Share Capital |

Year ended November 30, 2015

On June 3, 2015, the Company received $16,775 and $6,995 for the exercise of 105,600 warrants and 35,000 options respectively.

On June 19, 2015, the Company issued 7,575,757 common stock at price of $0.33 (CAD $0.40) per share on a non-brokered private placement basis and raised $2,500,000. There were no broker commissions or fees associated with this subscription. The closing of the private placement was approved by the TSX-Venture Exchange, as required under stock exchange rules.

Nine months ended August 31, 2016

The Company did not issue any shares during the nine- month period ended August 31, 2016.

8

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 5. |

STOCK BASED COMPENSATION |

|

Effective May 31, 2013, the Company adopted an incentive stock option plan (the “2013 Plan”), which replaces the stock option and stock bonus plans that were in place prior to adoption of the 2013 Plan. All outstanding options to purchase Common Shares granted by the Company under the prior plans are now governed by the 2013 Plan and the prior plans (an Incentive Stock Option Plan, a Non-Qualified Stock Option Plan, and a Stock Bonus Plan) have been terminated. | |

|

The purpose of this Plan is to authorize the grant to Eligible Persons of the Company of Options to purchase Shares and thus benefit the Company by enabling it to attract, retain and motivate Eligible Persons by providing them with the opportunity, through Options, to acquire an increased proprietary interest in the Company. | |

|

The maximum number of Shares which may be reserved for issuance to any one Consultant under the Plan, any other employer stock options plans or options for services, within any 12-month period, shall be 2% of the Shares issued and outstanding at the time of the grant (on a non-diluted basis). | |

|

The maximum number of Shares which may be reserved for issuance to Investor Relations Optionees under the Plan, any other employer stock options plans or options for services, within any 12-month period shall be 2% of the Shares issued and outstanding at the time of the grant (on a non-diluted basis). | |

|

The maximum number of Shares which may be reserved for issuance to insiders of the Company in any 12-month period shall be 10% of the Shares issued and outstanding at the start of such 12-month period (on a non-diluted basis). | |

|

The purchase price (the “Price”) for the Shares under each Option shall be determined by the Board of Directors or Committee, as applicable, on the basis of the market price, where “market price” shall mean the prior trading day closing price of the Shares on any stock exchange on which the Shares are listed or last trading price on the prior trading day on any dealing network where the Shares trade, and where there is no such closing price or trade on the prior trading day, “market price” shall mean the average of the daily high and low board lot trading prices of the Shares on any stock exchange on which the Shares are listed or dealing network on which the Shares trade for the five (5) immediately preceding trading days. In the event the Shares are listed on the TSXV, the price may be the market price less any discounts from the market price allowed by the TSXV, subject to a minimum price of CDN$0.10. | |

|

Year ended November 30, 2015 | |

|

On September 24, 2015, the board of directors extended the expiry dates of 572,000 warrants issued in 2010 to directors and officers at exercise price of $0.20, from original expiry date of September 30, 2015 to September 23, 2019. In addition, on same date, the board of directors extended the expiry dates of 1,470,000 warrants issued to directors and officers and 35,000 to a consultant, all issued in 2012 at exercise price of $0.13, from original expiry date of January 4, 2016 to September 23, 2019. The change in the terms of the warrants was determined to be a modification and not a cancellation and issuance of a new warrant. As a result of these modifications, the fair value of 2,077,000 warrants increased by $216,684. Fair value of warrants was calculated using the Black Scholes option pricing model with the following assumptions: |

| Risk free rate | 2.00% | |

| Expected dividends | 0% | |

| Forfeiture rate | 0% | |

| Volatility | 17.29% to 134.39% | |

| Warrant modification expense | $ 216,684 |

On October 20, 2015, the board of directors granted 1,350,000 options to directors and officers and 325,000 options to consultants to acquire a total of 1,675,000 common shares. These options were issued at an exercise price of $0.29 (CAD $0.38) per share and vest immediately with an expiry term of five years. The fair value of each option used for the purpose of estimating the stock compensation is calculated using the Black-Scholes option pricing model with the following assumptions:

| Risk free rate | 2.00% | |

| Expected dividends | 0% | |

| Forfeiture rate | 0% | |

| Volatility | 134.39% | |

| Market price of Company’s common stock on date of grant of options | $ 0.29 | |

| Stock-based compensation cost | $ 422,459 |

As of November 30, 2015 there was $Nil of unrecognized expense related to non-vested stock-based compensation arrangements granted.

Nine- month period ended August 31, 2016

On August 18, 2016, the board of directors granted options to a consultant to acquire a total of 25,000 common shares. These options were issued at an exercise price of $0.11 (CAD $0.14) per share and vest immediately with an expiry term of five years. The fair value of each option used for the purpose of estimating the stock compensation is calculated using the Black-Scholes option pricing model with the following assumptions:

| Risk free rate | 2.00% | |

| Expected dividends | 0% | |

| Forfeiture rate | 0% | |

| Volatility | 163.68% | |

| Market price of Company’s common stock on date of grant of options | $ 0.11 | |

| Stock-based compensation cost | $ 2,574 |

As of August 31, 2016 there was $Nil of unrecognized expense related to non-vested stock-based compensation arrangements granted.

9

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 6. |

RELATED PARTY TRANSACTIONS |

|

The following transactions are in the normal course of operations and are measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties. | |

|

Nine months ended August 31, 2016 | |

|

The directors were compensated as per their consulting agreements with the Company. The Company expensed a total of $208,400 as management fees to two of its directors in their role as officers in accordance with their consulting contracts, which included $57,600 paid on full and final settlement to one director in his role as CEO on his resignation and termination effective July 15, 2016, and also expensed a total of $5,900 as automobile allowance. In addition, the Company expensed $42,200 as a consulting fee to an independent director for services provided. | |

|

The Company expensed $16,400 for services provided by the CFO of the Company and $154,900 for services provided by a Corporation in which the Chief Operating Officer (who was later elected interim CEO and President effective July 16, 2016) has an ownership interest, in accordance with the consulting contract. | |

|

Effective July 21, 2016, Bryan Ganz was elected as a director of the Company. Prior to his appointment, effective May 1, 2016, the Company executed a one-year consulting agreement with a Corporation in which the said director has an ownership interest. The said Corporation was paid cash of $25,000 in May, 2016 and $25,000 in June, 2016. | |

|

The Company reimbursed $31,400 to directors and officers for travel and entertainment expenses incurred for the Company. |

10

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 6. |

RELATED PARTY TRANSACTIONS-Cont’d |

|

Nine months ended August 31, 2015 | |

|

The directors were compensated as per their consulting agreements with the Company. The Company expensed a total of $158,900 as management fees to these two directors, in their role as officers in accordance with their consulting contracts and expensed a total of $3,900 as automobile allowance. | |

|

The Company expensed $19,000 for services provided by the CFO of the Company and $166,500 for services provided by a Corporation in which the Chief Operating Officer has an ownership interest, in accordance with the consulting contract. | |

|

The Company reimbursed $65,700 to directors and officers for travel and entertainment expenses incurred for the Company. | |

| 7. |

COMMITMENTS |

a) Consulting agreements:

The non-independent directors of the Company executed consulting agreements with the company on the following terms:

Effective January 1, 2015, SDI executed a two- year agreement with a private company in which a director, Allen Ezer, has an ownership interest. The agreement is for a period of two years ending December 31, 2016 at a monthly fee of $6,694 (CAD $8,925) with a 5% increase effective January 1, 2016. Either party may terminate the consulting agreement by giving 90 days’ written notice. In the event of termination without cause due to change in control brought out by sale, lease, merger or transfer, the Company is obligated to pay 12 months’ fees at current rate at time of change in control. Effective February 1, 2015, the Company and director agreed to reduce the monthly fees by 10% to $6,024 (CAD $8,032). This reduction continued until the completion of the next round of financing, which was completed in May 2015. Effective September 16, 2016, Allen Ezer resigned the office of Executive Vice President (see Subsequent events note 12)

Effective October 1, 2014, SDI executed a renewal agreement with a private company in which the Chief Operating Officer Dean Thrasher has an ownership interest in, for a period which expires on December 31, 2017 for services rendered. The total consulting fees are estimated at $648,000 (CAD$864,000) for the three-year period. In the event of termination without cause due to change in control brought out by sale, lease, merger or transfer, the Company is obligated to pay 18 months’ fees at current rate at time of change in control. SDI paid cash and expensed $ 221,217 (CAD $230,892) during the year ended November 30, 2015. The company may also accept common shares in lieu of cash. As of May 31, 2016, the company has not exercised its right to accept this compensation in shares. Effective February 1, 2015, the Company and director agreed to reduce the monthly remuneration by 10% to $162,000 (CAD $21,600). This reduction continued until the completion of the next round of financing, which was completed in May 2015. On July 16, 2016, Dean Thrasher was appointed interim CEO and President of the Company. Effective August 1, 2016, the Company and director agreed to reduce the monthly consulting fees to $10,550 (CAD $14,000).

Effective July 21, 2016, Bryan Ganz was elected as a director of the Company. Prior to his appointment, effective May 1, 2016, the Company executed a one-year consulting agreement with a Corporation in which the said director has an ownership interest. The said Corporation will assist the Company with sales & marketing, expansion of the Company’s product range, review of operations, implementation of cost control measures, development of strategic alliances and financial oversight. For the consultant services and subject to TSX Venture Exchange Inc. (the “Stock Exchange”) approval, the consultant was paid cash for $50,000 and issued a value of $200,000 in Company’s stock in four quarterly installments over the 12-month period ending May 15, 2017. The first quarterly installment is due August 15, 2016. The stock will be priced at the volume weighted average trading price per common share over the 20- day period preceding the due date. (See also note 12 Subsequent events)

Effective November 1, 2013, SDI executed an agreement with a non-related consultant to pay compensation of $3,750 (CAD $5,000) per month. The consultant has agreed to provide corporate market advisory services. The agreement is for a period of a minimum of three months and will continue unless otherwise terminated by either party by giving 30 days’ written notice.

Effective May 1, 2015, SDI executed an agreement with another non-related consultant to pay compensation of $3,750 (CAD $5,000) per month. The consultant is to assist with sales initiatives, demos and participate in trade shows. The agreement unless renewed by mutual consent expires December 31, 2015. The consultant is also entitled to a 5% cash commission for all completed direct sales to end users and a 2% cash commission for all completed indirect sales. In addition, as a sales incentive, the company may grant stock options at market prices, being 25,000 stock options for every 5,000 rounds sold, to a maximum of 200,000 options. Either party may terminate the consulting agreement by giving 60 days’ written notice.

Effective April 2014, SDI executed an agreement with a non-related consultant to set up its social media sites and optimization of search engines for the Company, at a start- up fee for $2,250 (CAD$3,000) (Phase 1) and payment of $2,250 (CAD$3,000) per month and issued 150,000 stock options at $0.32 (CAD$0.38) when Phase 2 of the project was implemented.

Effective July 1, 2016, SDI renewed an agreement with a non-related consultant to pay compensation of $5,250 per month. The consultant is to assist with sales initiatives, demos and participate in trade shows. The agreement unless renewed by mutual consent expires December 31, 2016. The consultant is also entitled to a 5% cash commission for all completed direct sales to end users and a 2% cash commission for all completed indirect sales. The Company agreed to grant 25,000 stock options for every 5,000 rounds sold to a maximum of an additional 175,000 options. Either party may terminate the consulting agreement by giving 30 days’ written notice.

b) The Company has commitments for leasing office premises in Oakville, Ontario, Canada to April 30, 2018 at a monthly rent of $4,800 (CAD $6,399).

11

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 8. |

EXCLUSIVE SUPPLY AGREEMENT |

|

The Company entered into a Development, Supply and Manufacturing Agreement with the BIP Manufacturer on July 25, 2012. This Agreement provides the Company to order and purchase only from the BIP Manufacturer certain 40MM assemblies and components for use by the Company to produce less-lethal and training projectiles as described in the Agreement. The Agreement is for a term of five years with an automatic extension for an additional year if neither party has given written notice of termination prior to the end of the five-year period. | |

|

The Company and a division of Abrams Airborne Manufacturing Inc. (AAMI), namely Milkor USA (MUSA), agreed to partner for a joint cross-selling / marketing initiative. This arrangement allows both companies to leverage existing and future sales channels by offering a comprehensive, full-package of Milkor USA’s 40mm Multi-Shot Grenade Launchers in conjunction with SDI’s 40mm Less-Lethal ammunition product-line to end-users globally. |

12

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 9. | CONVERTIBLE DEBENTURES AND DEFERRED FINANCING COSTS |

| $1,398,592 (CAD $1,549,000) Convertible Debentures | |

|

On August 6, 2014, the Company issued $1,398,592 (CAD $1,549,000) face value 12% convertible debentures with a term to August 6, 2017 (the “Maturity Date”). At any time while the debentures are outstanding, the holder has the option to convert the outstanding principal of the debentures into common shares of the Company at a fixed conversion price of CAD $0.50 per share. At any time after February 6, 2015, the Company has the right to force the conversion of the debentures into common shares at a price of at least CAD$0.65 per common share for a period of at least 20 consecutive trading days. If the common shares do not trade on any trading day and the bid price of the common Shares is CAD $0.65 or greater, the common shares shall be deemed to have traded at a price of at least CAD $0.65 on that trading day. Additionally, the Company has the right to redeem the debentures, in whole or in part, (a) during the 12 months ending August 6, 2015, at a premium of 15% to the principal amount being redeemed plus any accrued interest, (b) during the 12 months ending August 6, 2016, at a premium of 5% to the principal amount being redeemed plus any accrued interest, (c) during the 12 months ending August 6, 2017, at a premium of 2% to the principal amount being redeemed plus any accrued interest. In connection with the financing, the Company issued warrants to placement agents to purchase 151,900 shares of common stock at an exercise price of CAD $0.50 per share. Additionally, the Company incurred $157,293 (CAD $174,209) in financing fees. | |

|

The Company has evaluated the terms and conditions of the convertible debentures and placement agent warrants under the guidance of ASC 815. The conversion feature met the definition of conventional convertible for purposes of applying the conventional convertible exemption. The definition of conventional contemplates a fixed number of shares issuable under the arrangement. The instrument was convertible into a fixed number of shares and there were no down round anti-dilution protection features contained in the contracts. The Company was required to consider whether the hybrid contract embodied a beneficial conversion feature (“BCF”). The debentures did not result in a BCF because the conversion price was not in the money on the inception date. There were no terms or features contained in the warrant agreement that would preclude the warrants from achieving equity classification. | |

| The following table reflects the allocation of the purchase on the financing date: |

| Convertible Debentures - Face Value | $ | 1,398,342 | ||

| Proceeds | $ | (1,279,773 | ) | |

| Deferred financing costs | (190,876 | ) | ||

| Paid in capital (warrants) | 33,583 | |||

| Prepaid expenses | 16,681 | |||

| Accrued expenses | 21,793 | |||

| Convertible debentures | 1,398,592 |

The warrants were valued at $33,583 and were recorded as a component of deferred financing costs. Interest expense related to the debentures amounted to $174,341 for the nine- month period ended August 31, 2016. Of the $174,341, $126,449 related to interest and the remaining $47,892 related to the amortization of deferred financing costs. Unamortized deferred financing costs as of August 31, 2016 consists of current costs of $59,216 (November 31, 2015: $63,741) and non- current costs of $nil (November 30, 2015: $43,367).

13

SECURITY DEVICES INTERNATIONAL, INC.

Notes to

Interim Consolidated Financial Statements

August 31, 2016

(Amounts expressed in US Dollars)

(Unaudited)

| 10. |

INVENTORY |

|

Inventory as of August 31, 2016 consist of finished goods of Blunt Impact Projectiles 40mm for $7,004 (November 30, 2015: $30,329) and 40mm LMT launchers for $9,980 (November 30, 2015: $13,990) which are held at the BIP manufacturer. | |

| 11. |

SEGMENT DISCLOSURES |

|

The Company is organized in two geographic areas in the U.S.A. and Canada respectively. The U.S.A. and Canada operations are our operating and reportable segments. Performance is assessed and resources are allocated by the Company. Management evaluates these segments based primarily upon revenue and assets. The tables below present segment sales and assets for the nine months ended | |

|

August 31, 2016 and August 31, 2015. |

Sales

| SDI | ||||||||||

| SDI | Canada | Total | ||||||||

| Nine months ended August 31, 2016 | $ | 47,945 | $ | 34,904 | $ | 82,849 | ||||

| Nine months ended August 31, 2015 | $ | 19,223 | $ | 66,139 | $ | 85,362 |

| 2016 | 2015 | ||||||

| Total Sales | $ | 109,578 | $ | 145,602 | |||

| Elimination of intersegment revenue | (26,729 | ) | (60,240 | ) | |||

| Net sales | $ | 82,849 | 85,362 |

| Assets | ||||||||||

| SDI | SDI Canada | Total | ||||||||

| Nine months ended August 31, 2016 | $ | 579,906 | $ | 145,139 | $ | 725,045 | ||||

| Nine months ended August 31, 2015 | $ | 2,097,459 | $ | 224,204 | $ | 2,321,663 |

| 12. |

SUBSEQUENT EVENTS | |

| a) |

Effective May 1, 2016, the Company executed a one-year consulting agreement with a Corporation. For the consultant services, the consultant was paid cash for $50,000 and issued a value of $200,000 in Company’s stock in four quarterly instalments over the 12-month period ending May 15, 2017. In September 2016, the Company issued 488,851 common stock to the consultant being the first quarterly instalment for a value of $50,000 which was due August 15, 2016. | |

| b) |

Effective September 16, 2016, Allen Ezer resigned the office of Executive Vice President but will continue as a director of the Company until the earlier of a) date a replacement director is appointed or b) December 31, 2016. | |

| c) |

Effective September 27, 2016, Dave Goodbrand resigned as a director from the Company. | |

14

PART II

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF OPERATION

THREE MONTHS ENDED AUGUST 31, 2016

The following discussion and analysis of the financial condition and results of Security Devices International, Inc. (also referred to as "we", "us", "our", "SDI", or the "Company"), should be read in conjunction with the Company's financial statements (and related notes) as at November 30, 2015.

The following discussion contains forward-looking statements, which are subject to risks and uncertainties and other factors that may cause SDI’s results to differ materially from expectations. When reviewing the Company's forward-looking statements, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. These include risk relating to market fluctuations, performance, , strength of the North American and other world economies and foreign exchange fluctuations. These forward-looking statements speak only as of the date hereof. Unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update these forward-looking statements. The Company does have an ongoing obligation to disclose material information as it becomes available. The discussion also includes cautionary statements about these matters. You should read the cautionary statements made below as being applicable to all forward-looking statements wherever they appear in this document.

Industry Overview

It is the Company’s belief that the United States, along with most parts of the world are in the very early stages of a significant spike in the growth curve for “less-lethal” products. Most law enforcement agencies do not have a proper working knowledge of a less-lethal program in place. Rather they are using an assortment of less-lethal devices out of necessity for varying degrees of effectiveness with little coordination or approved tactical plans for their deployment. Law enforcement budget constraints usually play a role in this behavior. It is for this reason that unintended deaths of unarmed suspects at the hands of police departments throughout the country (and in fact throughout the world) continue to happen.

With a rise in social and civil unrest both here and abroad and with more and more of these incidents being caught on video and posted on social media, the pressure on law enforcement and governments to find reasonable and effective alternatives to lethal force is mounting daily. As a result, it is management’s opinion that the less-lethal market will be one of the faster growing segment in the law enforcement, correctional services, crowd control and security services markets over the next decade.

Less-lethal weapons include a wide variety of products designed to disorient, slow down and stop would be assailants, rioters and other malfeasants. In the Company’s opinion, the less-lethal weapon that is growing the fastest in popularity and adoption is the 40mm launcher along with the various less-lethal munitions that can be fired from these launchers. These munitions include both impact rounds designed to stop an individual without causing permanent injury to payload rounds carrying a variety of powders and liquids including tear gas, pepper spray, DNA marking liquids, mal-odorants and other marking liquids and powders designed to identify instigators in a riot situation.

Historically, these munitions were fired from 37mm launchers, however, the industry has been moving to 40mm launchers due to the fact that the 40mm launcher barrel is rifled (while the 37mm is a smooth bore barrel less accurate munition) which allows the operator to more accurately fire the rounds at distances in excess of 100’. This makes the 40mm launcher an effective tool in a wide range of situations.

15

Business

History

Security Devices International Inc. (the “Company” or the “Corporation”) was incorporated on March 1, 2005. The Company began as a research and development company focused on the development of 40mm less-lethal ammunition.

The Company initiated with the development of a wireless electric projectile (the “WEP”), named the Lektrox. The Company hired a ballistics engineering firm to collaborate in the development of the WEP.

Commencing in December 2008, the Joint Non-Lethal Weapons Directorate (“JNLWD”) of the US Department of Defense, an organization responsible for the development and coordination of non-lethal weapons activities within the United States, tested the WEP through its evaluation facility at Penn State University. An executive summary was released to the Company indicating a positive outcome.

In the fall of 2010 the Company underwent a change in the board of directors and management. This precipitated a change in the direction of the company as development of the WEP was discontinued and the company shifted its focus to a new product – the Blunt Impact Projectile (BIP). The Company concluded that the cost and time required to complete development and testing of the BIP were significantly less than that required to complete development and testing of the WEP. The goal was to develop a product that it could bring to market more quickly. The Company was able to exploit some of the patent pending technology of the WEP into the BIP. In 2011, the Company moved its engineering, intellectual property and production facilities to the operator (the “BIP Manufacturer”) of an injection molding facility outside of Boston, Massachusetts.

The Blunt Impact Projectile (BIP) – A Transformative Technology

When the less-lethal industry was dominated by the 37mm launcher, a number of less-lethal companies developed “impact munition rounds” designed to “stop” an assailant. These round were nothing more than a piece of plastic, wood baton, rubber baton, or a piece of plastic with a piece of sponge rubber or foam rubber affixed to the head of the round.

There were several problems with these rounds. First, they were inaccurate due to the lack of barrel rifling. Since most SWAT teams carry single shot launchers, a round that cannot be shot accurately is of little value. Second, because of their lightweight, they did not have much stopping power. Suspects that were “committed” would often “shake off” a direct hit. Finally, the rounds would bounce off walls or other hard surfaces which made them dangerous to use in confined areas such as a jail cell. Numerous corrections officers have been hurt by impact rounds ricocheting off of jail cell walls.

Security Devices International solved all three issues with the development of its “Blunt Impact Projectile” (BIP). The BIP was developed as an outgrowth of a research and development project to create a conductive electric device bullet (project name WEP – Wireless Electric Projectile).

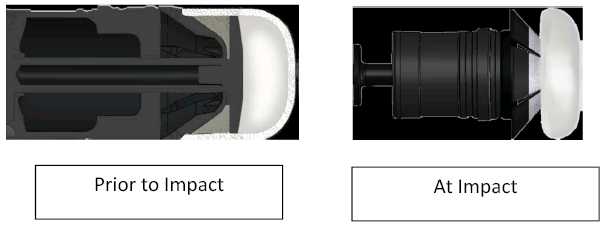

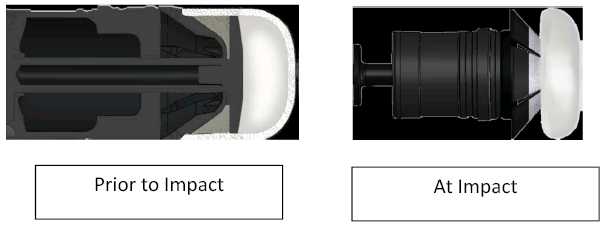

In order to ensure that the projectile did not injure the targeted individual, SDI needed to develop a way to cushion the impact of the round upon contact with the target. The solution was a collapsible head that compressed upon impact. (See below). When it became clear that SDI did not have sufficient funds to complete development of the WEP, it was decided to use the collapsible head design to create an impact round. The hope was that with this new, state-of-the-art impact round, SDI could generate enough profitability that it would be able to complete development of the WEP.

16

This collapsible head technology allowed SDI to build a heavier projectile that did not require a rubber or foam tip. This meant that it could take advantage of the rifling of the 40mm launcher. This made the BIP by far the most accurate round on the market in comparison to previous 37mm projectiles. The target for an impact round is to be a large muscle group such as the thigh muscle.

The gel collapsible head of the BIP spreads out upon impact, dispersing the energy over a larger area thus reducing blunt trauma to the subject. This allows the BIP round to be fired at close range on a target.

The Company believes that its patented collapsible head technology will transform the industry as law enforcement agencies recognize the tactical advantages of a less-lethal weapon that can be safely, accurately and effectively deployed at close range distances between 3 feet and 100 feet. There is simply nothing else on the market today that can compete with the BIP. SDI has been in discussions several industry players about licensing SDI’s technology.

Early in 2011 the Company focused its attention on a new 40mm product, the blunt impact projectile (“BIP”), and discontinued further development work on the WEP.

2012

In June 2012, the Company contracted CRT Less Lethal Inc. (“CRT”) to test the BIP. Based on data obtained from the three-stage evaluation, the BIP passed the CRT testing protocol for accuracy, consistency, relative safety and effectiveness.

In July 2012, the Company signed a five-year development, supply and manufacturing agreement with a subcontractor to Manufacture the BIP.

In November 2012, the Company obtained a United States Department of Transportation number (DOT#) required in order for the Company to ship BIP rounds.

17

In 2012, the Company began the development of five new less-lethal ammunition rounds. These new rounds will be a modified version of the BIP, four of which carry a payload, including; BIP MP (temporary powder-based marking agent), BIP ML (semi-permanent liquid marking agent), BIP OC (Oleoresin Capsicum - a pepper spray powder), BIP MO (malodorant liquid), and the BIP TR (training round).

2013

The Company moved its full manufacturing and supply chain operations to the BIP manufacturer, a supply manufacturing and engineering company, in the Boston, MA area.

The Company undertook an Initial Public Offering (IPO) in January and became a public reporting issuer on the TSX-Venture Exchange in September 2013.

2014

SDI began another globally recognized testing protocol with a military agency called HECOE (the Human Effects Centre of Excellence). This world-renowned agency is located in the Air Force Research Laboratory (AFRL), in partnership with the US Joint Non-lethal Weapons Directorate (JNLWD). This group conducts research to assist Non-lethal Weapon (NLW) Program Managers across the U.S. Department of Defense (DoD) in assessing effectiveness and risks of NLWs. The positive conclusion of this testing allows DOD to purchase SDI rounds.

April - SDI appointed Keith Morrison to the board of directors as non-executive Chairman

May - SDI’s BIP rounds were used at the Mock Prison Riot in West Virginia. Law enforcement and correctional services officers provided feedback on new technologies (such as SDI’s products) to assist in the effectiveness of their jobs.

August - The Company completed the issuance of 1,549 convertible unsecured debentures at $1,000 per debenture for gross proceeds of $1,549,000 (the “Private Placement”).

October - Security Devices International Inc. announced that the Company and a division of Abrams Airborne Manufacturing Inc. (AAMI), namely Milkor USA (MUSA), have agreed to partner for a joint cross-selling / marketing initiative.

November - The Company named Karim Kanji to the board of directors as an independent member.

SDI has sold their BIP products into nine new agencies during the fiscal year of 2014 including Sheriff Departments, Correctional Services, and SWAT teams in; Saskatoon, SK, Watertown, SD, Abbotsford, BC, Sacramento, CA, Kingston, ON, Rustburg, VA, Orlando, FL, Montreal, QC, and Bedford, VA. These agencies are additions to SDI’s customer base that have adopted its 40mm less-lethal rounds.

2015

In January 2015, SDI commenced a public relations program and through the year, SDI has been featured in over 700 media outlets globally, including live interviews on FOX television, News One in New York, and CP24 in Toronto.

18

March - SDI was invited to speak at the Launch festival in San Francisco, to present their innovative less-lethal technology during a panel discussion on the future of policing. The Launch festival focuses on start-up and emerging technology companies and the festival was streamed to approximately 4 million viewers.

During the second quarter, SDI attended the American Jail Association’s annual conference in North Carolina and performed a live fire demonstration to numerous State and local Agencies while in North Carolina.

During Q2, SDI also attended the Canadian Tactical Conference in Collingwood, Ontario as well as the New York Tactical Conference in Verona, New York.

Through SDI’s distributor (U.S. Tactical Supply– GSA) the Company was able to leverage their relationship to facilitate a live-fire demonstration for the Pentagon Protection Force in Alexandria, Virginia.

In May - SDI participated in the “Mock Prison Riot” which takes place annually at a decommissioned penitentiary in Moundsville, West Virginia. The Mock Prison Riot is a four-day, comprehensive law enforcement and corrections tactical and technology experience, including 40,000 square feet of exhibit space, training scenarios, technology demonstrations, certification workshops, a Skills Competition, and unlimited opportunities for feedback and networking on a global scale.

SDI enhanced their customer base in the quarter by adding 9 new agencies in multiple States and Provinces both in Canada and the US.

SDI staff attended the Ohio Tactical officers conference in June where the Company not only had a full exhibit booth set up to bring awareness to SDI’s full line of less lethal 40MM products but also conducted live fire demonstrations to several agencies. These agencies had requested seeing the projectiles fired to move forward with evaluation of SDI’s products for potential inclusion in their less lethal arsenal.

July - SDI was invited to present the company’s full line of products to the New York City Police Department. Representatives of SDI attended the NYPD range and conducted in-class presentations followed by a live fire demonstration showcasing the full line on 40MM products that SDI can offer for Law Enforcement operational missions.

July - The Associated Press (“AP”), conducted interviews with SDI management and attended SDI’s manufacturing partners’ location for an in depth look at the company and the technology. The AP completed a story on the uniqueness of the product line and the increased element of safety that SDI’s products offer, and released the story to the newswire, where it was picked up by approximately 800 media outlets, worldwide.

August - SDI was invited to present to the Toronto Police Service (“TPS”), who are currently exploring less lethal options for front line officers. A full presentation was given to decision makers of the TPS and a follow-up live fire demonstration is to occur.

September – SDI conducted their Annual General Meeting and shareholders approved the following:

| 1) |

The Board of Directors, as it stands today, was re-elected. | |

| 2) |

Schwartz Levitsky Feldman, LLP was re-appointed as SDI’s auditors. | |

| 3) |

Approval of an amendment to Company’s by-laws concerning the quorum required to hold a meeting of shareholders. | |

| 4) |

Approval of the Company’s incentive stock option plan. | |

| 5) |

Approval of an amendment to the Company’s articles to prohibit the issuance of shares of preferred stock having multiple voting attributes. |

In FY2015, SDI added 24 new Law Enforcement and Correctional Agencies to its paid customer base. The Company as at fiscal yearend holds 40 agencies as customers.

19

Q1 FY2016

In December 2015, SDI was invited to conduct a full product briefing and live fire demonstration for key Management with the United Sates Federal Bureau of Prisons. SDI was able to showcase the innovation of the BIP family of products and demonstrate the clear difference between SDI’s products and other products on the market.

In January 2016, SDI management attended the SHOT show in Las Vegas and met with numerous existing partners and explored future partnerships with several other Industry leaders.

During the SHOT show SDI’s rounds were used by AAMI, an existing partner of SDI, during a new product innovation range day that was attended by the majority of Companies in the firearms industry.

During Q1, SDI is pleased to announce that it received its first sale of 40MM launchers to a Law Enforcement Agency. This is an important step for SDI to be seen as having the availability to access other less lethal products to fulfil customer requests.

In January, SDI and Clyde Armory, signed a distribution agreement whereas Clyde will offer SDI’s product line to Law Enforcement customers in their catchment area. Clyde is a full service gun store which supplies firearms, ammunition and accessories to Law Enforcement and Civilian customers. They are based in Athens, Georgia.

During this quarter, the non-exclusive renewable Technology License and Supply Agreement that was signed with United Tactical Solutions on April 17, 2015, was terminated by SDI management effective February 25, 2016.

On February 29, 2016, SDI signed a term sheet with an existing defense technology (less lethal) company to acquire that Company. This acquisition, if completed, will give SDI a diversified line of less lethal munitions, launchers and accessories as well as opening domestic and global distribution channels.

Q2 FY2016

During the second quarter of 2016, the Company continued to pursue the targeted acquisition through several funding sources, and financing structures. Subsequent to the quarter, on July 8, 2016, the Company announced that it had identified a number of items in the target company’s (the “Target”) financial statements that raised concerns in support of the negotiated price of the transaction. SDI has terminated discussions with the Target at this time.

Subsequent to the quarter, the Company announced that Gregory Sullivan has resigned as President and CEO to pursue other opportunities, effective July 15, 2016. Dean Thrasher, the current COO and a member of the SDI board of directors will assume the interim role of President and CEO. Mr. Sullivan will remain on the board of directors until his replacement is appointed and receives stock exchange clearance, or September 1, 2016, whichever occurs first.

The Company signed a one-year consulting agreement with Northeast Industrial Partners LLP (“Northeast”), which is headed up by Mr. Bryan Ganz. Northeast will assist SDI with sales & marketing, expansion of the Company’s product range, review of operations, implementation of cost control measures, development of strategic alliances and financial oversight. Mr. Ganz brings more than 30 years of experience in sales management, manufacturing, new product design and development as well as mergers & acquisitions. During his career Mr. Ganz has bought, built and sold more than half a dozen global businesses with combined sales in excess of $1.0 billion. Most recently, Mr. Ganz sold Maine Industrial Tire LLC to Trelleborg (based out of Sweden), for $67 million generating a 7.0x return to investors over a three-year period.

20

For their services and subject to stock exchange approval, Northeast will be issued a value of US$200,000 in SDI stock in four quarterly instalments over the 12-month period ending May 15, 2017. The first quarterly instalment is due August 15, 2016. The stock will be priced at the volume weighted average trading price per common share over the 20-day period preceding the due date. The stock will vest at the end of the contract with Northeast.

NEIP is currently the controlling shareholder in two operating businesses and a 250-unit residential real estate portfolio in the New England area. Northeast also owns minority stakes in a number of public and private businesses including a California company developing wireless electricity. Mr. Ganz is a graduate of Columbia Law School in New York City and completed his accounting designation at Georgetown University in Washington DC.

The Company wishes to inform the market that a Schedule 13D was filed with the SEC on June 8, 2016 by SDI’s largest group of shareholders in the US, holding approximately 10,474,522 shares. The 13D filing by the “reporting persons” relates to the maximizing of shareholder value with the intention of engaging more substantively with management, the board of directors and other relevant parties on matters concerning the business, assets, capitalization, operations and strategy of SDI. The 13D filing says that the reporting person may also discuss strategic alternatives with interested parties to propose or consider extraordinary transactions including joint ventures, mergers or a sale transaction of the Company.

Q3 FY2016

During Q3 2016 SDI announced that it has terminated its proposed acquisition of a less-lethal company, as previously released on May 13, 2016, and April 21, 2016.

During the Company’s due diligence process, SDI identified a number of items in the target company’s (the “Target”) financial statements that raised concerns in support of the negotiated price of the transaction. SDI terminated discussions with the Target during this quarter.

SDI’s management continues to look for acquisitions and strategic partnerships in the less-lethal sector, to broaden its product offering and increase its distribution reach. SDI is currently in preliminary discussions to license its collapsible technology to other less lethal market participants. SDI’s objective is to both (1) increase revenues and (2) gain greater market acceptance for the BIP.

During Q3 the Company announced the signing of a sales and distribution agreement with the Bob Barker Company (“Bob Barker”), the nation’s preeminent correctional services supplier, for distribution of SDI’s products through their Officers Only distribution network.

A division of the Bob Barker Company, “Officers Only” is a reliable source for quality apparel and offers a broad and diverse product lineup of protective and essential equipment that are brand recognized and trusted by law enforcement, corrections, military and public service office. SDI will continue to look for qualified distributors as part of its new sales and marketing strategy with a goal of tripling the number of SDI distributors by the end of 2017.

Effective September 15, 2016 Allen Ezer resigned as Executive Vice President to pursue other opportunities. He will remain as a Director until the upcoming Annual General Meeting. Northeast Industrial Partners has taken on the sales position of Mr. Ezer in the interim. Subsequent to the quarter, SDI reported that it has made the first share issuance to Northeast Industrial Partners under the consulting agreement announced on June 20, 2016. SDI issued 488,851 common shares at a deemed price of $ 0.1023 (CAD $0.1322) per share to satisfy the payment of USD $50,000 due on August 15, 2016. The shares will be subject to a four-month hold period expiring on January 13, 2017, and will not vest until May 2017.

21

The issuance of shares to Northeast Industrial Partners is the first of four such issuances to occur over the period ending May 15, 2017, as described in the June 20, 2016 news release.

During Q3, SDI appointed Bryan Ganz to the board of directors. With the appointment of Mr. Ganz to the board of directors, the previously announced resignation of Greg Sullivan (previous CEO) as a director becomes effective.

Operations

The Company has reduced its production costs of its most popular products during the last quarter. These cost reductions will support SDI’s sales blitz efforts to continue to gain market penetration in the law enforcement, correctional services and private sector segments.

Website Update

SDI has updated its website to continue to manage its digital presence, as well as maintain its top positioning in search engines for the less-lethal industry. The Company has also revised it messaging to respond to recent global law enforcement confrontations, such as incidents in the US, South America and in Europe.

Products

SDI’s business is the development, manufacture and sale of less-lethal ammunition. This ammunition is used by the military, correctional services, and police agencies for crowd control.

The Company has two products:

| a) |

The Company has developed the BIP, a blunt impact projectile which uses pain compliance to control a target. The Company has developed six versions of the standard BIP, five of which contain a payload and one of which is a cheaper cost, training round. A payload is an internal medium within the BIP, holding a liquid or powder substance. | |

| b) |

The Company has undertaken substantial work to develop the WEP, a wireless electric projective which releases an electrical pulse that induces a muscle spasm and causes the target to fall to the ground helpless. |

Intellectual Property

Five patent applications, four non-provisional and one provisional, have been filed by the Company with the U.S. Patent Office. The Patents have been granted on the four non-provisional patents.

Non-Provisional (granted patents):

(a) Less-lethal Projectile: This issued patent relates to the Company’s distinctive collapsible ammunition head technology that absorbs kinetic energy of the projectile upon impact. The Corporation’s collapsible head is used in both the BIP and the WEP.

(b) Electronic Circuitry for Incapacitating a Living Target: This issued patent relates to the electronic circuitry incapacitation system which forms part of the WEP. The patent describes an electronic circuit which provides an electrical incapacitation current to a living target.

22

(c) Less-lethal Wireless Stun Projectile System for Immobilizing a Target by Neuro-Muscular Disruption: This issued patent describes the process by which the WEP operates with its attachment system to halt a target through a neuro-muscular-disruption system.

(d) Autonomous Operation of a Less-lethal Projectile: This patent describes a motion sensing system within the WEP. The sensor will monitor movement of the target and enable the electrical output until the target is subdued. The electrical pulse is programmed for an exact time-frame to specifications of the user.

Provisional Patent:

(e) Payload carrying arrangement for a non-lethal projectile: This Provisional patent relates to the process of carrying liquid and powder payloads in the head of the BIP munitions that upon impact release from the head and are dispersed upon the target.

The Company’s policy has been to write off cost incurred in connection with non-provisional and provisional patent costs as they are incurred as a recoverability of such expenditure is uncertain.

General

23

Going Concern

The Company has incurred a cumulative loss of $27,937,161 from inception to August 31, 2016. The Company has funded operations through the issuance of capital stock and convertible debentures. The Company has started to generate revenue from operations. However, it still expects to incur significant expenses before becoming profitable. The Company’s future success is dependent upon its ability to raise sufficient capital or generate adequate revenue, to cover its ongoing operating expenses, and also to continue to develop and be able to profitably market its products. These factors raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

In addition to raising funds in the prior years, the Company raised $878,328 by issue of Convertible Debentures during the year ended November 30, 2011 and $910,000 during the year ended November 30, 2012. In addition, the Company raised $649,750 by issuance of 2,165,834 common shares during the year ended November 30, 2012. On August 15, 2013, the Company filed an amended and restated final prospectus (the “Prospectus”) in Canada, in the provinces of Alberta, British Columbia and Ontario for listing its shares in these provinces in Canada. On August 27, 2013 the Company completed an initial public offering to raise gross proceeds of CAD $3,993,980 (US $3,794,280) through the issuance of 9,984,950 Common Shares at a price of CAD $0.40 (US $0.38) per Common Share (the “Issue Price”). During the year ended November 30, 2014, the Company issued $1,398,592 (CAD $1,549,000) face value 12% convertible debentures with a term to August 6, 2017 (the “Maturity Date”) and raised net $1,241,299. In 2015, the Company raised $2,500,000 through the issuance of 7,575,757 common shares and also issued 105,600 common shares on exercise of warrants for $16,775 and 35,000 common shares on exercise of options for $6,995. The Company’s common shares commenced trading on the TSX Venture Exchange (“TSX”) under the symbol “SDZ”.

Significant Quarterly Information

The following represents selected information of the Company for the most recently completed financial quarter ended August 31, 2016

| Three- month | Three- month | |||||

| period | period | |||||

| August 31, | August 31, | |||||

| 2016 | 2015 | |||||

| (unaudited) | (unaudited) | |||||

| Net loss for the three- month period | 491,928 | 467,538 | ||||

| Basic and diluted loss per share | (0.01 | ) | (0.01 | ) |

24

| As at | As at | |||||

| August 31, | November | |||||

| 2016 | 30, 2015 | |||||

| Total assets | 725,045 | 2,166,418 | ||||

| Total liabilities | 1,481,060 | 1,571,921 | ||||

| Cash dividends per share | - | - |

Results of Operations

SDI was incorporated on March 1, 2005 and for the period from inception to August 31, 2016 has not realized significant revenues. The company has started to generate revenue from operations. However, it still expects to incur expenses before becoming profitable.

Financial highlights (unaudited) for the three month and nine- month period ending August 31, 2016 and 2015 with comparatives are as follows:

| Operating Results | For the three months | For the three months | ||||

| ended | ended | |||||

| August 31, | August 31, | |||||

| 2016 | 2015 | |||||

| $ | $ | |||||

| Sales | 30,627 | 10,757 | ||||

| Cost of sales | (18,684 | ) | (5,480 | ) | ||

| Gross Profit | 11,943 | 5,277 | ||||

| Operating Expenses | (445,546 | ) | (414,490 | ) | ||

| Other expenses -Interest | (58,325 | ) | (58,325 | ) | ||

| Net Loss for Period | (491,928 | ) | (467,538 | ) | ||

| (Loss) per Share | ($0.01 | ) | ($0.01 | ) |

| Operating Results | For the nine months | For the nine months | ||||

| ended | ended | |||||

| August 31, | August 31, | |||||

| 2016 | 2015 | |||||

| $ | $ | |||||

| Sales | 82,849 | 85,362 | ||||

| Cost of sales | (51,021 | ) | (65,048 | ) | ||

| Gross Profit | 31,828 | 20,314 | ||||

| Operating Expenses | (1,201,441 | ) | (1,271,620 | ) | ||

| Other expenses -Interest | (174,341 | ) | (173,707 | ) | ||

| Net Loss for Period | (1,343,954 | ) | (1,425,013 | ) | ||

| (Loss) per Share | ($0.02 | ) | ($0.03 | ) |

The Company’s selected information for the nine- month period ended August 31, 2016 (unaudited) and November 30, 2015 (audited) are as follows:

| August 31, | November | |||||

| 2016 | 30, 2015 | |||||

| Total current assets | 662,921 | 2,026,040 | ||||

| Total assets | 725,045 | 2,166,418 | ||||

| Total current liabilities | 1,481,060 | 173,329 | ||||

| Total liabilities | 1,481,060 | 1,571,921 | ||||

| Stockholders’ equity (deficiency) | (756,015 | ) | 594,497 |

25

Net loss for the three months ended August 31, 2016 was $491,928 ($0.01 per share) as compared to $467,538 ($0.01 per share) for the three- month period ended August 31, 2015.

Cash Flows

Net cash used in operations for the nine months ended August 31, 2016, was $1,347,521 as compared to $1,417,684 used for the nine months ended August 31, 2015. The major components of change relate to:

Changes in non- cash balances relating to operations:

The Company’s inventory costs decreased by $27,335 in 2016 as compared to decrease of $51,318 in 2015. This decrease represents the investment in inventory available for sale in next period. Accounts receivable decreased by $22,944 in 2016 as compared to an increase of $8,939 in 2015.

Net Cash flow from financing activities was $2,523,770 in 2015 as compared to $nil in 2016. During the prior period, the Company received cash for $2,500,000 relating to issuance for 7,575,757 common stock at a price of $0.33 (CAD $0.41) per share on a non-brokered private placement basis.

There was an overall decrease in cash and cash equivalent of $1,362,797 in 2016 as compared to an increase in cash and cash equivalent of $1,075,942 during 2015. The increase in 2015 was primarily the result of receipt of cash for $2,500,000 from issuance of common stock.

Liquidity and Capital Resources

As at August 31, 2016, cash and cash equivalent was $488,224, as compared to $1,851,021 at November 30, 2015. This decrease is mainly attributable to the combination of factors mentioned above under heading “Cash Flows”.

At August 31, 2016, the Company had a working capital deficit of $818,139. The major components are as follows; cash and cash equivalent for $488,224; prepaid expenses and other receivables $83,623; Inventory for $16,984; deferred financing costs for $59,216; accounts receivable for $14,874; accounts payable and accrued liabilities of 82,468 and convertible debentures for $1,398,592.

At November 30, 2015, the Company had a working capital of $1,852,711. The major components are as follows; cash and cash equivalent $1,851,021; prepaid expenses and other receivables $27,283; Inventory for $44,319; deferred financing costs for $63,741; accounts receivable for $39,676; and accounts payable and accrued liabilities of $173,329.

26

Off-balance sheet arrangements

The Company has no significant off-balance sheet arrangements at this time.

Transactions with related parties

The following transactions are in the normal course of operations and are measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties.

Nine months ended August 31, 2016

The directors were compensated as per their consulting agreements with the Company. The Company expensed a total of $208,400 as management fees to two of its directors in their role as officers in accordance with their consulting contracts, which included $57,600 paid on full and final settlement to one director in his role as CEO on his resignation and termination effective July 15, 2016, and also expensed an additional $5,900 as automobile allowance. In addition, the Company expensed $42,200 as a consulting fee to an independent director for services provided.