UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

BYRNA TECHNOLOGIES INC.

(Name of Registrant as specified in its Charter)

(Name of Person(s) Filing Proxy Statement), if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

BYRNA TECHNOLOGIES INC.

100 Burtt Road, Suite 115

Andover, MA 01810

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Byrna Technologies Inc., a Delaware corporation (the “Company” or “Byrna”), to be held at 9:00 a.m., Eastern Standard Time, on Friday, May 19, 2023 at the offices of Byrna Technologies, Inc. 100 Burtt Rd., Suite 115, Andover, MA 01810. At the meeting, we will be voting on the matters described in the accompanying Proxy Statement.

Items of Business

|

1. |

To elect five (5) directors named in the company’s proxy statement to serve until the next Annual Meeting of Stockholders or until their respective successors are qualified and elected (the “Election of Directors Proposal”); |

|

2. |

To ratify the appointment of EisnerAmper LLP as Byrna’s independent registered public accountants for the fiscal year ending November 30, 2023 (the “Auditor Ratification Proposal”); |

|

3. |

To approve, by non-binding vote, the Company’s executive compensation (“say on pay”); and |

|

4. |

To transact such other business as may properly come before the meeting. |

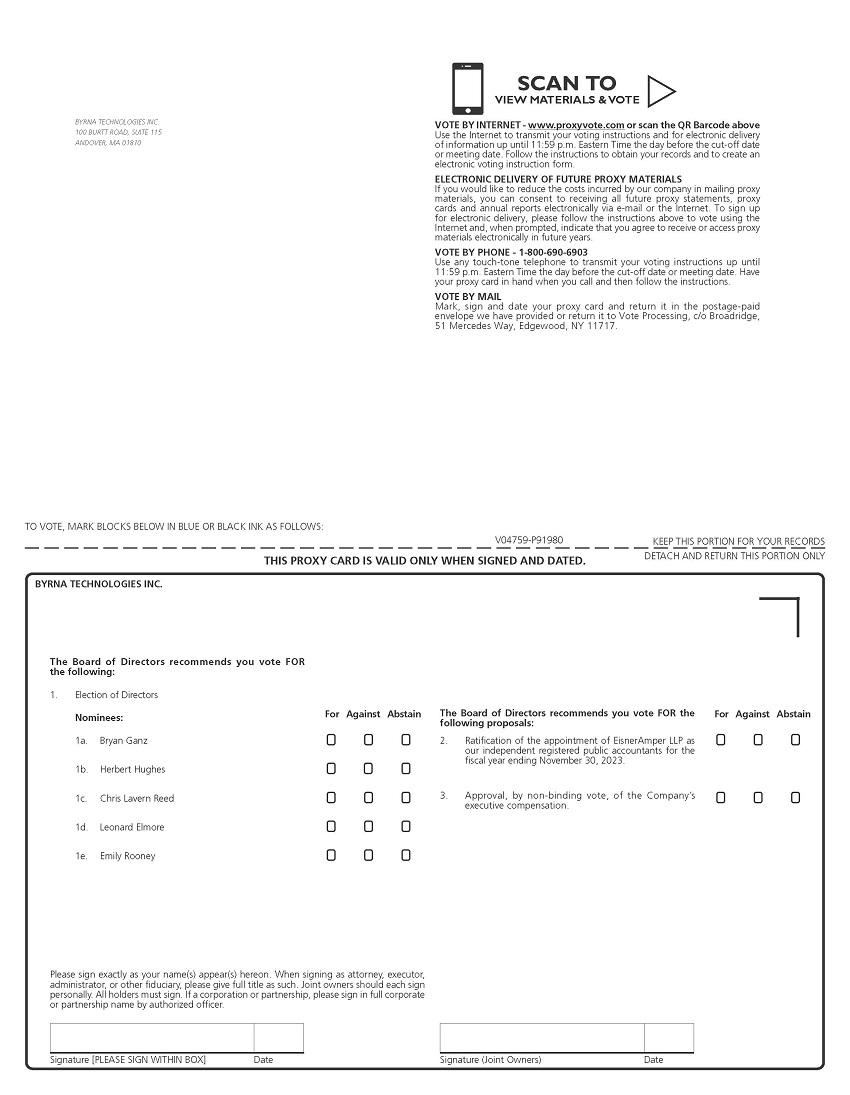

Voting

Only stockholders of record as shown in the books of our transfer agent at the close of business on March 22, 2023 are entitled to notice of, and to vote at, the Annual Meeting. At least ten days prior to the meeting, a complete list of stockholders entitled to vote will be available for inspection by any stockholder for any purpose germane to the meeting, during ordinary business hours, at the Company’s corporate headquarters, 100 Burtt Road, Suite 115, Andover, MA 01810.

On or about March 30, 2023, a Notice of Internet Availability of Proxy Materials and Notice of Annual Meeting of Stockholders (the “Notice”) is first being mailed to our stockholders of record as of the Record Date and our proxy materials are first being posted on the website referenced in the Notice (www.proxyvote.com). We are using the Internet as our primary means of furnishing the proxy materials to our stockholders because it expedites the delivery of proxy materials, keeps them easily accessible to stockholders, and provides stockholders with clear instructions for accessing materials and voting.

In addition, the Notice of Internet Availability of Proxy Materials contains instructions on how you may (i) receive a paper copy of the Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2022 (the “Annual Report”), if you received only a Notice of Internet Availability of Proxy Materials this year, or (ii) elect to receive your Proxy Statement and Annual Report only over the Internet in the future, if you received them by mail this year.

Regardless of whether you expect to attend the meeting, please vote in advance of the meeting by using one of the methods described in the Company’s proxy statement (the “Proxy Statement”). As a stockholder of record, you may vote your shares (1) at the meeting, (2) by telephone, (3) through the Internet, or (4) by completing and mailing a proxy card if you receive your proxy materials by mail. Specific instructions for voting by telephone or through the Internet are included in the Notice and in the Proxy Statement. If you attend and vote at the meeting, your vote at the meeting will replace any earlier vote you cast.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on Friday, May 19, 2023: The Proxy Statement and the Annual Report are available at www.proxyvote.com. The Annual Report, however, is not part of the proxy solicitation material.

By Order of the Board of Directors

/s/ Lisa Wager

Corporate Secretary

100 Burtt Road, Suite 115

Andover MA 01810

March 30, 2023

Even though you may plan to attend the meeting, please vote by telephone, through the Internet, or, if you receive your proxy materials by mail, execute the enclosed proxy card and mail it promptly in the accompanying postage-free return envelope. Stockholders who received proxy materials in the mail are also welcome to vote by telephone or through the internet by following the instructions on the proxy card. Should you attend the meeting, you may revoke your proxy and vote at the meeting if you wish to change your vote.

ABOUT THE MEETING

BYRNA TECHNOLOGIES INC.

100 Burtt Road, Suite 115

Andover, MA 01810

2023 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Byrna Technologies Inc. (“Byrna”, the “Company,” “we,” “us,” or “our”) to be voted at our 2023 Annual Meeting of Stockholders (the “Annual Meeting”). On or about March 30, 2023, a Notice of Internet Availability of Proxy Materials and Notice of Annual Meeting of Stockholders (the “Notice”) is first being mailed to our stockholders of record as of March 22, 2023, the Record Date, and our notice of annual meeting, proxy materials, and 2022 Annual Report are first being posted on the website referenced in the Notice (www.proxyvote.com). All website addresses given in this document are for informational purposes only and are not intended to be an active link or to incorporate any website information into this document.

Stockholders as of the Record Date are invited to attend our annual meeting which will take place on Friday, May 19, 2023, beginning at 9:00 a.m. Eastern Time at the offices of Byrna Technologies, Inc. 100 Burtt Rd., Suite 115, Andover, MA 01810, and any adjournments or postponements thereof. You may obtain directions to the Annual Meeting at www.proxyvote.com.

Whether or not you are able to attend the annual meeting, you are urged to vote your proxy, either by mail (if you receive your proxy materials by mail), telephone or on the Internet. Specific instructions for voting by telephone or through the Internet are included in the Notice and in this Proxy Statement. If you attend and vote at the meeting, your vote at the meeting will replace any earlier vote you cast. Proxies also may be voted at any adjournment or postponement of the Annual Meeting.

ABOUT THE MEETING

BYRNA TECHNOLOGIES INC.

PROXY STATEMENT FOR THE

2023 ANNUAL MEETING OF STOCKHOLDERS

ABOUT THE MEETING

This summary highlights selected information contained in this Proxy Statement. Please review the entire Proxy Statement and our 2022 Annual Report before voting your shares.

ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: | 9:00 a.m., Eastern Time, Friday, May 19, 2023 |

| Meeting Location: | Offices of Byrna Technologies, Inc. 100 Burtt Rd., Suite 115, Andover, MA 01810 |

| Record Date: | March 22, 2023 |

| Voting: | Stockholders as of the Record Date are entitled to vote. Each share of common stock is entitled to vote for each director nominee and one vote for each of the other proposals to be voted on. |

ANNUAL MEETING AGENDA

|

Proposal |

Board Recommendation |

More Information |

|

|

1. |

Election of the five directors named in this Proxy Statement |

FOR EACH NOMINEE |

Page 14 |

|

2. |

Ratification of the appointment of EisnerAmper LLP as the Company's independent registered public accountants for the fiscal year ending November 30, 2023 |

FOR |

Page 43 |

|

3. |

Approval, by non-binding vote, of the Company's executive compensation ("Say on Pay") |

FOR |

Page 44 |

2022 PERFORMANCE HIGHLIGHTS

|

● |

Revenues rose 13.7% to $48.0 million in the fiscal year ended November 30, 2022 (FY22) from $42.2 million in the fiscal year ended November 30, 2021 (FY21). |

|

● |

Gross profit increased by 14.8% to $26.3 million in FY22 from $22.9 million in FY21. |

|

● |

Gross margin improved to 54.7% in FY22 from 54.3% in FY21. |

|

● |

Net loss of $(7.9) million in FY22 compared to net loss of $(3.3) million in FY 2021. |

|

● |

Stock repurchases of 2,165,987 shares for $17.5 million at average share price of $8.08. |

NOTABLE ACHIEVEMENTS TOWARDS LONG TERM GOALS

|

● |

Entry to Sportsman’s Warehouse, Bass Pro Shops and Cabela’s. |

|

● |

New enlarged manufacturing facilities opened in the U.S. and South Africa. |

|

● |

Entry to self-defense spray market with acquisition of Fox Labs increased aerosol sales from $0 in FY21 to $0.8 million in FY22. |

ELECTION OF DIRECTORS: BOARD NOMINEES

|

Name |

Age |

Director Since |

Committee Memberships |

Other Current Public Company Boards |

|

Bryan Ganz |

65 |

2016 |

Product Safety |

|

|

Herbert Hughes Independent |

63 |

2019 |

Audit (Chair) Compensation Governance |

|

|

Chris Lavern Reed Independent |

54 |

2020 |

Audit Compensation (Chair) Governance Product Safety |

|

|

Emily Rooney Independent |

73 |

2021 |

Governance Product Safety (Chair) |

|

|

Leonard Elmore Independent |

71 |

2021 |

Audit Governance (Chair) |

1800Flowers.com |

ABOUT THE MEETING

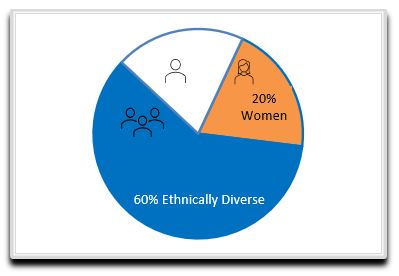

Board Composition Overview:

Board Composition Highlights:

|

● |

Number of Independent Directors: 4 of 5 (80%) |

|

● |

Number of Gender or Ethnically Diverse Directors: 4 of 5 (80%) |

|

● |

Number of Women Chairing Standing Committees: 1 of 4 (25%) |

|

● |

100% of our Committee Chairs Are Independent and Gender or Ethnically Diverse |

|

● |

None of our Non-Employee Directors Serve as an Executive Officer of a Public Company |

|

● |

None of our Directors Serve on more than one other Public Company Board |

Our Board has diverse and varied experiences, backgrounds and strengths. Our four independent directors, led by Board Chair Herbert Hughes, who has the longest tenure with the Company of any of our directors, play a vital role in oversight of risk areas and strategic guidance. Mr. Hughes succeeded Mr. Ganz as Chair on June 17, 2022 upon conclusion of our 2022 Annual Meeting of Stockholders. We believe it is in the best interests of the Company and its stockholders that the roles of Chair and CEO be bifurcated given Mr. Hughes’ familiarity with the Company and depth of experience.

ADVISORY VOTE: INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

We are asking stockholders to vote FOR the ratification of the selection of EisnerAmper LLP as our independent registered public accountants for the fiscal year ending November 30, 2023.

ADVISORY VOTE: APPROVAL OF EXECUTIVE COMPENSATION: NAMED EXECUTIVE OFFICERS

Our named executive officers for our 2022 fiscal year were:

|

• |

Bryan Ganz, Chief Executive Officer |

|

• |

David North, Chief Financial Officer |

|

• |

Luan Pham, Chief Marketing Officer |

We are asking our stockholders to approve on an advisory basis the Company’s executive compensation. Our Board recommends a FOR vote because we believe our compensation program aligns the interests of our named executive officers with those of our stockholders and achieves our compensation objective of rewarding management based upon individual and Company performance and the creation of stockholder value over the long term. Although stockholder votes on executive compensation are non-binding, the Board and the Compensation Committee consider the results when reviewing whether any changes should be made to our compensation program and policies.

ABOUT THE MEETING

Why did I receive this Proxy Statement?

Our Board is soliciting your proxy to vote on your behalf at the meeting because you were a stockholder of our Company as of March 22, 2023, the Record Date, and entitled to vote.

This Proxy Statement summarizes the information you need to know in order to cast your votes at the meeting.

What Is the Effect of Signing the Proxy Card?

The Proxy Card appoints Bryan Ganz, our Chief Executive Officer, or in his absence David North, our Chief Financial Officer, and Lisa Wager, our Chief Governance Officer and Corporate Secretary, or either of them, as your representative at the Annual Meeting. As your representatives, they will vote your shares of common stock at the Annual Meeting (or any adjournments or postponements) in accordance with your instructions on your proxy card. You may appoint a different person as proxy if you prefer but they will only be able to vote if they attend the meeting. If you want to appoint some other person to represent you at the Annual Meeting, you may do so either by inserting such person’s name in the blank space provided in the form of proxy or by providing another form of proxy.

What am I voting on?

You are voting on six items:

|

• |

Election of directors named in this Proxy Statement (see page 14); |

|

• |

Ratification of the appointment of EisnerAmper LLP as our independent registered public accountants for fiscal year 2023 (see page 43); and |

|

• |

Approval, by non-binding vote, of the Company’s executive compensation (see page 44). |

How do I vote?

| Stockholders of record | Street name holders | ||

|

Stockholders of record, have four ways to vote:

|

Vote on the Internet www.proxyvote.com |

If your shares are held in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares held in “street name” and not a stockholder of record. | |

|

Vote by Phone 1-800-690-6903 |

As a beneficial owner, you may direct your broker, bank or other agent on how to vote the shares in your account by following voting instructions that they provide, or you may obtain a proxy issued in your name from them. | |

|

Vote by Mail Complete, sign and mail your proxy |

Beneficial owners who do not obtain a proxy from their broker may also attend the meeting (with appropriate identification and subject to any limits that may be placed by the Corporate Secretary on attendance by non- record holders and in the interests of the safety of attendees). | |

|

Vote at the Meeting | ||

| Voting by telephone and on the internet will close at 11:59 p.m. Eastern Daylight Time on May 18, 2023. | |||

ABOUT THE MEETING

Has the Board of Directors made any recommendations on voting?

Yes. The Board recommendations are as follows:

|

Proposal |

Board Recommendation |

|

|

1. |

Election of the five directors named in this Proxy Statement |

FOR EACH NOMINEE |

|

2. |

Ratification of the appointment of EisnerAmper LLP as the Company's independent registered public accountants for the fiscal year ending November 30, 2023 |

FOR |

|

3. |

Approval, by non-binding vote, of the Company's executive compensation ("Say on Pay") |

FOR |

Will any other matters be voted on?

We are not aware of any other matters that will be brought before the stockholders for a vote at the Annual meeting. If any other matter is properly brought before the meeting, your proxy card gives authority to Bryan Ganz, and in his absence David North and Lisa Wager, or either of them, to vote your shares at their discretion on such other matters.

How many voting stockholders do you need to hold the Annual Meeting?

To conduct the Annual Meeting, we must have a quorum, which means that one third (1/3) of our outstanding voting shares as of the record date must be present, in person or by proxy, at the Annual Meeting. If you vote or abstain on any matter your shares will be part of the quorum. If you hold your shares in street name and do not provide voting instructions to your broker, bank, trustee or other nominee, but your broker, bank, trustee, or other nominee has and exercises discretionary authority to vote on at least one matter, your shares will be counted in determining the quorum for all matters to be voted on at the meeting. Brokers have discretionary authority relating to the ratification of independent public accountants.

Why should I submit a proxy if I intend to attend the Annual Meeting?

Even if you plan to attend the Annual Meeting, it is a good idea to complete, sign and return your proxy card in case your plans change. We also ask that you vote by proxy even if you intend to attend the meeting so that we will know as soon as possible that we have a quorum. This also saves us the additional costs of having to solicit proxies to ensure a quorum.

Your shares of Common Stock represented by the proxy will be voted in accordance with your instructions and if you specify a choice with respect to any matter to be acted upon, your shares of Common Stock will be voted accordingly.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 22, 2023, the record date for the Annual Meeting, are entitled to receive notice of and to vote at the meeting. If you were a stockholder of record on the Record Date you can vote all shares that you held on that date at the meeting or at any postponement or adjournment of the meeting.

ABOUT THE MEETING

If I submit a Proxy without indicating my vote on all matters, will it be voted?

A properly executed proxy that does not include instructions to vote on one or more matters will be voted as follows:

FOR each director nominee named in the proxy materials; and

FOR ratification of EisnerAmper LLP as our independent registered public accountants for the fiscal year ending November 30, 2023;

FOR the approval, by non-binding vote, of the Company’s executive compensation.

What if I abstain from voting?

Abstentions with respect to a proposal are counted for the purposes of establishing a quorum. If a quorum is present, abstentions will not be included in vote totals.

Since our bylaws provide that approval of a proposal at an Annual Meeting of the stockholders is generally by the affirmative vote of a majority of the voting shares present, in person or by proxy, at an Annual Meeting of the stockholders and entitled to vote on the applicable matter, a properly executed proxy card marked ABSTAIN with respect to a proposal will have the same effect as voting AGAINST that proposal. However, election of Directors is by a majority of the votes cast at the Annual Meeting with respect to a nominee, meaning that the number of shares voted FOR a nominee must exceed the number of shares voted AGAINST the nominee. A properly executed proxy card marked ABSTAIN with respect to the election of any Director nominee will not affect the approval of the nominee.

Why haven’t I received a physical copy of the Proxy Statement or Annual Report?

The Securities and Exchange Commission rules allow companies to save on printing and mailing expenses by furnishing proxy materials via the Internet to stockholders who prefer to review the materials online. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail unless you submit a specific request. Instructions are included in the Notice to make such a request for printed materials if you so desire. It also provides instructions on how to access all the materials and how to submit your proxy over the internet.

How many votes do I have?

You have one vote for each share of common stock you owned at the close of business on the Record Date.

How many shares can be voted at the Annual Meeting in total?

As of the Record Date, we had 53 stockholders of record and 21,866,209 shares outstanding, each of which is entitled to one vote at the meeting. Cumulative voting is not permitted.

ABOUT THE MEETING

What number of votes is required to elect each of the directors?

Assuming a quorum is present, each director nominee named in Proposal 1, the election of the directors, must be elected by the affirmative vote of a majority of the votes cast in an uncontested election. In other words, each director will be elected if more shares are voted FOR his or her election than are voted AGAINST his or her election. Any share that does not cast a vote for a director (including abstentions and broker non-votes, explained below) does not count as a vote against the director. Under Delaware law, any incumbent director who does not receive the affirmative vote of a majority of the votes cast at the Annual Meeting will continue to serve on the Board as a “holdover director.” In accordance with our by-laws, each of our standing directors has tendered a resignation from the Board, conditioned on the incumbent director’s failure to receive a majority of the votes cast. If an incumbent director does not receive a majority of the votes cast, our Nominating and Governance Committee will make a recommendation to the Board of Directors on whether to accept or reject the resignation or take any other action. The Board of Directors will act on the committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of our election results.

What number of votes is required on proposals other than the election of directors?

Other than the election of directors, all other proposals shall be decided by the affirmative vote of the majority of shares present or represented by proxy at the meeting and entitled to vote on the applicable matter, assuming a quorum is present.

Can I change my vote or revoke my proxy after I submit my vote?

Yes. If you vote prior to the meeting, you may change your vote or revoke your proxy at any time before the votes are cast at the Annual Meeting by sending in a new proxy card with a later date, or by casting a new vote by telephone or on the Internet (not later than 11:59 p.m. Eastern Daylight Time on Thursday, May 18, 2023, or by sending a written notice of revocation to our Corporate Secretary at our corporate headquarters, 100 Burt Rd Suite 115, Andover, MA 01810. You also may automatically revoke your proxy by attending the Annual Meeting and voting there if you are a record stockholder. Attending the Annual Meeting without voting at such meeting will not in and of itself constitute revocation of a proxy.

If you are a beneficial stockholder but not a stockholder of record, then to revoke your voting instructions, you may submit new voting instructions to your broker, trustee or nominee or you can obtain an individual proxy from your nominee and attend the meeting to vote.

What is a broker non-vote and what effect does it have?

Brokers and other intermediaries who hold shares of Common Stock in street name for their customers, generally are required to vote the shares of Common Stock in the manner directed by their customers. If their customers do not give any direction, brokers may vote shares of Common Stock on routine matters. However, in the absence of customer direction for voting on non-routine matters, brokers may not vote shares of Common Stock on those matters, which is referred to as a broker non-vote. The only matter that brokers will be able vote on without specific direction at the Annual Meeting is Proposal 2, ratification of EisnerAmper LLP as our independent registered public accountants.

Any shares of Common Stock represented at the Annual Meeting but not voted (whether by abstention, broker non-vote or otherwise) will have no impact in the election of directors except to the extent that the failure to vote for an individual results in another individual receiving a larger proportion of votes cast. Any broker non-votes with respect to all other non-routine proposals will not affect the approval of such proposals. In recognition of our desire to have every stockholder vote count, we encourage our stockholders to instruct their brokers to vote their shares.

Where can I find the voting results of the Annual Meeting?

We will publish the final results in a current report filing on Form 8-K with the United States Securities and Exchange Commission (the “SEC”) within four business days of the Annual Meeting.

Who will pay for the costs of soliciting proxies?

We will pay the entire expense of soliciting proxies for the Annual Meeting. In addition to solicitations by mail, certain of our directors, officers and employees (who will receive no compensation for their services other than their regular compensation) may solicit proxies by telephone, telegram, personal interview, facsimile, e-mail or other means of electronic communication. Banks, brokerage houses, custodians, nominees, and other fiduciaries have been requested to forward proxy materials to the beneficial owners of shares of common stock held of record by them as of the Record Date, and such custodians will be reimbursed for their expenses.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on Friday, May 19, 2023: The Proxy Statement and the Annual Report are available at www.proxyvote.com. The Annual Report, however, is not part of the proxy solicitation material.

PROPOSAL 1: ELECTION OF DIRECTORS

PROPOSAL 1: ELECTION OF DIRECTOR NOMINEES

The Board of Directors of the Company currently consists of five members. Once elected, directors serve for one-year terms with all directors being elected by our stockholders at each annual meeting to succeed the directors whose terms are then expiring. Each nominee elected as a director will continue in office until his or her successor has been duly elected and qualified or until his or her earlier resignation or removal.

At the Annual Meeting, five directors, nominated by the Board of Directors, will stand for election to serve until the 2024 annual meeting of stockholders. At the recommendation of the Nominating and Governance Committee, the Board of Directors has nominated Bryan Ganz, Herbert Hughes, Chris Lavern Reed, Emily Rooney, and Leonard Elmore for election as the directors of the Company. The nominees have agreed to stand for election and, if elected, to serve as directors. However, if any person nominated by the Board of Directors is unable to serve or will not serve, the proxies will be voted for the election of such other person or persons as the Nominating and Governance Committee and the Board of Directors may recommend.

Vote Required

The affirmative vote of a majority of the votes cast by holders of shares of common stock present or represented by proxy and entitled to vote on the matter at the Annual Meeting is required for the election of the director nominees as directors of the Company. meaning that the number of shares voted FOR a nominee must exceed the number of shares voted AGAINST the nominee. Any share that does not cast a vote for a director (including abstentions and broker non-votes) does not count as a vote against the director. See “What number of votes is required to elect each of the directors?” on page 12.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NOMINEES.

PROPOSAL 1: ELECTION OF DIRECTORS

Director Biographies: Summary

|

Name |

Age |

Director Since |

Committee Memberships |

Other Current Public Company Boards |

|

Bryan Ganz |

65 |

2016 |

Product Safety |

|

|

Herbert Hughes Independent |

63 |

2019 |

Audit (Chair) Compensation Governance |

|

|

Chris Lavern Reed Independent |

54 |

2020 |

Audit Compensation (Chair) Governance Product Safety |

|

|

Emily Rooney Independent |

73 |

2021 |

Governance Product Safety (Chair) |

|

|

Leonard Elmore Independent |

71 |

2021 (FY22) |

Audit Governance (Chair) |

1800Flowers.com |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominee Biographies

Below are the biographies of our Director nominees, all of whom are incumbent directors.

|

Bryan Scott Ganz became the Company’s President effective July 13, 2018, Chief Executive Officer effective April 1, 2019, and has been a director since June 2016. and a member of the Product Safety Committee since June 2022. Mr. Ganz served as Board Chair between April 2019 and June 2022. Prior to becoming the Company’s President, he was engaged by the Company, beginning in May 2016, in a consulting capacity to assist in a restructuring of operations, evaluation of management, identify sources of capital, and provide strategic advice. Mr. Ganz brings more than 30 years of global business experience in sales management, manufacturing, new product design and development, and supply chain management, and mergers and acquisitions as well as experience as a director of other publicly held companies. Previously, Mr. Ganz founded Maine Industrial Tire LLC, an industrial tire company sold to a unit of Trelleborg AB in 2012. From 1991 to 2009 Mr. Ganz held several roles culminating with CEO of GPX International, Inc. and its predecessor Galaxy Tire Inc. Mr. Ganz started his career at Paramount Capital Group where he was a partner from 1985 to 1991. Mr. Ganz is the founder and majority shareholder of Northeast Industrial Partners LLC, a holding company that owns and operates privately held businesses. In addition, he is a principal in Scudder Bay Capital LLC, a captive private REIT. Mr. Ganz received a J.D. from Columbia Law School and a B.S. in Business Administration from Georgetown University. During Mr. Ganz’s tenure, the Company has transitioned from the research and development stage to produce and sell multiple unique products including less lethal launchers, projectiles, and other personal security tools. Key achievements during this period included listing on Nasdaq, eliminating all long term debt, development of a robust DTC ecommerce program, including Amazon, establishment of a nationwide network of dealers including such large chain sporting goods stores as Cabela’s, Bass Pro, and Sportsman’s Warehouse, establishment of new enlarged manufacturing facilities in the U.S. and South Africa, entry into the Canadian and Latin American markets including ongoing development of a manufacturing facility in Argentina, successfully completing a share repurchase program, establishing a talented and diverse Board of Directors, and establishing a first class operational infrastructure with a dynamic, experienced quality leadership team. He also has emphasized management accountability, initiating programs to align management and shareholder interests, control operating costs, and improve profit margins. Through his personal work ethic, Mr. Ganz leads the management team by example. |

|

Herbert Hughes has been a director since July 9, 2019. He served as Lead Independent Director from December 2021 through June 2022 and was appointed as Chair in June 2022. Mr. Hughes is Chair of the Audit Committee, a member of the Compensation Committee, and a member of the Nominating and Governance Committee. Mr. Hughes previously served as Chair of an Ad Hoc Committee during 2021 and 2022 overseeing the establishment of the Company’s stock repurchase program. Mr. Hughes has over three decades of experience in finance, risk management, operational management, and derivatives modeling as an advisor and leader of a diverse range of businesses and is an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. Since March 2017, Mr. Hughes has been Chief Financial Officer of Wormhole Labs, a metaverse emerging technology company using mixed and augmented applications in enterprise and consumer markets, and has served on its board of directors. At Wormhole Mr. Hughes is responsible for financial reporting, capital structure and formation, and SAAS and ecommerce negotiations, and has worked with the Chief Technology Officer on issues related development of Wormhole’s cybersecurity program. Mr. Hughes has held executive level positions in several industries including technology, hospitality, asset management, oil and gas exploration and production, and oil industry services. Through his professional investment and advisory positions, Mr. Hughes has gained valuable experience with some of the unique challenges related to leadership and growth of an early-stage technology business. Mr. Hughes received a B.A. from Harvard University. Mr. Hughes is a member of the Minnesota Chippewa tribe and the National Congress of American Indians. Mr. Hughes is the Company’s first independent Chair and during his tenure as Lead Independent Director and as Chair he has focused the Board on the Company’s strategic plans to achieve short- and long-term shareholder value, on management oversight of key drivers and, with the Nominating and Governance Committee, on improving board communications, efficiency, and focus. During his tenure as Chair of the Audit Committee, the Company has eliminated material weaknesses in its financial processes and controls and established a robust oversight program to monitor financial and enterprise risk including retention and continuity of a Chief Financial Officer and independent public auditing firm, and overseen management’s development of a comprehensive program for timely and reliable financial reporting and controls, including systems and controls |

PROPOSAL 1: ELECTION OF DIRECTORS

|

Chris Lavern Reed has been a Director since September 1, 2020 and, since April 2012, has been the managing partner of Garcia Reed Investments, LLC, a real estate management entity. Mr. Reed is Chair of the Compensation Committee and is a member of the Audit, Nominating and Governance, and Product Safety Committees. Mr. Reed has over three decades of experience in global law enforcement. From October 2018 through April 29, 2022, he served as a rehired annuitant for the U.S. Department of State, overseeing classified investigations. From December 2016 to July 2018, Mr. Reed served as the Special Agent in Charge and Director at the U.S. Agency for International Development Office of Inspector General (USAID OIG). Prior to his leadership role with USAID, Mr. Reed served in numerous leadership roles within the U.S. Department of Justice, Bureau of Alcohol, Tobacco, Firearms and Explosives (“BATF”). Through his work, Mr. Reed has established professional qualifications and training in leadership, security, and financial crime investigations and has strategic and operational experience related to financial risk and fraud matters. Mr. Reed has served as an instructor for the U.S. Department of State Foreign Service Institute and has spoken internationally on the topics of fraud, corruption, and a host of investigative topics. He has served as a subject matter expert in the U.S. Senate on law enforcement, homeland security and fraud issues. Through his government work, Mr. Reed has developed an understanding of complex public policy matters, the government contracting process, and has extensive experience in crisis management and global law enforcement training. He has completed continuing education coursework related to cybercrime, online fraud and business identity theft, among other cybersecurity topics, is a member of the Police Executive Research Forum, the Association of Certified Fraud Examiners and has been a Certified Fraud Examiner since April 2018. Mr. Reed also is a graduate of Georgetown University’s Congressional Fellow Program and has completed Columbia Business School’s Executive Development and Management Programs. Through his business degree, professional certifications, 10 plus years of business experience in the private sector, over 30 years of experience in relevant global and federal law enforcement, and BATF experience, Mr. Reed has developed a broad legal and technical knowledge base including expertise related to money-laundering, bribery, financial fraud corruption and internal conflict of interest schemes designed to hide illicit proceeds. His education, experience and training bring the Board critical oversight and investigative skills, important subject matter expertise, and a high degree of financial literacy. A veteran of the U.S. Marine Corps., he received an M.B.A. from Champlain College, an M.A. from Northern Arizona University, and a B.A. from Indiana University. During Mr. Reed’s tenure as Chair of the Nominating and Governance Committee, shareholders approved amendments to the Company’s charter to reduce the number of shares authorized from 300,000,000 to 50,000,000, established a new Product Safety Committee of the Board and a management Product Safety Committee, and, working with the Compensation Committee, closely oversaw management’s efforts to evaluate and improve workplace environment and employee recruitment and retention programs. As a direct result of this effort, and during Mr. Reed’s Chairmanship of the Compensation Committee, the Company has addressed retention challenges in past incentive compensation by, among other things, establishing a comprehensive short- and long-term employee incentive program designed to motivate and reward high performing employees at different levels, motivate new hires, and align employees interests with those of the Company’s shareholders. |

|

Emily Rooney has been a director since October 1, 2021. She also chairs the Company’s Product Safety Committee and serves on the Nominating and Governance Committee. She previously served on the Audit Committee from October 2021 to June 2022 and on an Ad Hoc Committee during 2021 and 2022 overseeing the establishment of the Company’s stock repurchase program. Ms. Rooney has over 40 years of experience as a journalist. Since October 1, 2021, she has been working with Muddhouse Media producing a bi-monthly podcast entitled “Beat the Press” which can be heard through Spotify and Apple Music. From December 1998 through September 2021, she was Executive Editor and host for WGBH’s Emmy Award winning television show Beat the Press, examining media coverage of current events. From January 1997 to December 2014, she was also the creator, Executive Editor, and host of the television show Greater Boston with Emily Rooney. Previously she was the political director for Fox News in New York and Executive Producer of World News Tonight with Peter Jennings, positions in which she oversaw multimillion-dollar budgets. Ms. Rooney’s deep understanding and discerning examination of media, politics, and culture, and her writing and speaking skills, have earned her numerous awards, including the National Press Club’s Arthur Rowse Award for Press Criticism, a series of New England Emmy Awards, and Associated Press recognition for Best News/Talk Show. As an investigative journalist she has examined such company relevant topics as media coverage, financial fraud, police use of lethal force, social justice initiatives, and legislative initiatives related to gun control. Ms. Rooney’s deep understanding of politics, culture, the media, and public sentiment, are beneficial to the Board in overseeing the development of the Company’s business strategy. Ms. Rooney received a B.A. from The American University, Washington D.C. Ms. Rooney has been instrumental in overseeing management’s establishment of procedures to seek to ensure safety of its products and communications related to product safety and safe product use. |

PROPOSAL 1: ELECTION OF DIRECTORS

|

Leonard Elmore has been a director since December 2021. He serves as Chair of the Nominating and Governance Committee and as a member of the Audit Committee. He previously served as a member of an Ad Hoc Committee during 2021 and 2022 the Product Safety Committee from December 2021 to June 2022 overseeing the establishment of the Company’s stock repurchase program. Mr. Elmore is a retired attorney and business leader, a television sports personality, and an educator. He has a wide spectrum of experience in the private and public sectors, and, through his Co-Chairmanship of the John and James L. Knight Foundation’s Knight Commission on Intercollegiate Athletics, is involved in public interest initiatives directed at promoting diversity, inclusion, and reform in college athletics. A former collegiate basketball All American at the University of Maryland at College Park and a ten-year professional player in both the ABA and NBA, Mr. Elmore has been a Broadcast Analyst for the BIG Ten Network since November 2020. Since August 2018, Mr. Elmore has also served as Senior Lecturer in Discipline at the Columbia University School of Professional Studies Sports Management Program. Mr. Elmore’s prior business experience includes serving as Chief Executive Officer of iHoops, the official youth basketball initiative of the NCAA and NBA, and as the President of Test University, a leading provider of internet-delivered learning solutions for pre-college students. As a practicing attorney, Mr. Elmore was a Partner with the law firm of Dreier LLP and, before that, Senior Counsel with LeBoeuf, Lamb, et. al. (subsequently, Dewey & LeBoeuf). He began his legal career as an Assistant District Attorney with the King’s County (Brooklyn) District Attorney in New York City. Mr. Elmore has extensive public and private Board experience. Since October 2020, Mr. Elmore has been a member of the Board of Directors of 1800Flowers.com (Nasdaq: FLWS), a leading online and telephonic gift and flower retailer, and is the Chair of its Nominating and Corporate Governance Committee. From 2007 until February 2020, Mr. Elmore served as a Director on the Board of Directors of Lee Enterprises, Inc. (Nasdaq: LEE), a newspaper publishing company, where he served on the Audit Committee. He also sat on the Board of iHoops from its foundation. Mr. Elmore has been involved for over a decade in public interest endeavors of the John and James L. Knight Foundation’s Knight Commission on Intercollegiate Athletics, whose focus is to develop, promote and lead transformational change that prioritizes the education, health, safety and success of college athletes, and currently serves as one of the Commission’s Co-Chairs. He chairs the Commission’s Racial Equity Task Force and is a member of its Leadership Committee. He also is on the Board of Advisors of the Shirley Povich Center for Sports Journalism at the University of Maryland College Park Merrill School of Journalism. He received a J.D. from Harvard Law School and a B.A. from the University of Maryland. Mr. Elmore’s education, business experience and experience as a director of other public companies, including as a member of Audit and Governance committees, bring the Board experience in oversight (including of financial reporting and ESG areas), public relations (including media relationships), and a high degree of financial literacy. During his tenure on the Nominating and Governance Committee Mr. Elmore has been instrumental in the transition to an independent Chair, the restructuring of the Compensation Committee’s responsibilities to improve Board efficiency, improvements to the Board self-evaluation process, and development of new ESG related policies including, development of policies to encourage a Speak Up culture, an Anti-Child Labor Policy, Anti-Human Trafficking Policy, New Stockholder Communication Protocol, adoption of Anti-discrimination on the Basis of Gender Identity statements, and development underway of several employee-related programs and sustainability initiatives. |

PROPOSAL 1: ELECTION OF DIRECTORS

Board Diversity Matrix (As of March 20, 2023)

|

Total Number of Directors |

5 |

|||

|

Part I. Gender Identity |

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|

Directors |

1 |

4 |

- |

- |

|

Part II. Demographic Background |

||||

|

African American or Black |

- |

2 |

- |

- |

|

Alaskan Native or Native American |

- |

1 |

- |

- |

|

Asian |

- |

- |

- |

- |

|

Hispanic or Latinx |

- |

- |

- |

- |

|

Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

|

White |

1 |

2 |

- |

- |

|

Two or More Races or Ethnicities |

- |

1* |

- |

- |

|

LGBTQ+ |

- |

- |

- |

- |

|

Did Not Disclose Demographic Background |

- |

- |

- |

- |

*One director self-identifies as White and Native American so he is identified under both of those categories as well as under “Two or More Races or Ethnicities.”

Board Composition

Our current Board is composed of five Directors, each of whom are standing for reelection at the Annual Meeting. Except for Bryan Ganz, our CEO and President, all of our directors are independent. None of our directors is an executive officer of any other public company or serve on the boards of more than one other public company. All Directors serve one-year terms until their successors are elected and qualified at the next annual meeting of our stockholders. Directors are elected by a majority of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting, except in the event that there are more nominees running than positions open.

Criteria for Board Membership and Board Refreshment

The Nominating and Governance Committee Charter provides that the committee will consider such factors as it deems relevant in evaluating and recommending director candidates, including, without limitation, skill, diversity, integrity, experience with comparable businesses and other organizations, experience relevant to the needs of the Company, leadership qualities, and the extent to which a candidate would be a desirable addition to the Board. Because the current board is relatively small in size by choice to contain costs, we also seek directors who are not committed as executive officers of other public companies or on more than two other boards, to ensure that our directors can commit the time needed to guide the Company and provide effective oversight of our strategy and business plans. Finally, we seek to refresh the board thoughtfully so that we may have a mix of perspectives of longer serving directors and those who recently joined the Board.

We recognize the value of seeking out directors from various backgrounds and professions and diverse in age, gender, race, and ethnicity so that the Board as a whole can draw on its breadth and depth to inform its decisions. Our five board nominees bring diversity in ethnicity, gender, professional experience and tenure. Our Board has varied experiences, backgrounds, and strengths. Our four independent directors, led by Herbert Hughes as Board Chair, who has the longest tenure with the Company of any of our directors, play a vital role in oversight of risk areas and strategic guidance.

Leadership Structure of the Board of Directors

Mr. Hughes, our longest-tenured independent director, has served as Board Chair since June 2022 and, prior to that, served as Lead Independent Director beginning in December 2021. Mr. Ganz, our President and Chief Executive Officer, served as Board Chair from April 2019 until June 2022. At the present time, we believe that having a non-executive Chair serves the best interests of the Company and our stockholders.

PROPOSAL 1: ELECTION OF DIRECTORS

The separation of the Chair from the Chief Executive Officer is intended to assure the independence and effectiveness of the Board in its oversight role of evaluating the Chief Executive Officer and senior management. It also allows Mr. Ganz to focus on managing the Company’s business and operations and allows Mr. Hughes to focus on Board matters.

Role of Board in Risk Oversight Process

Our Board of Directors has responsibility for the oversight of the Company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from Board committees and members of senior management to enable our Board to understand the Company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The Audit Committee reviews information regarding liquidity and operations and oversees our management of financial risks. Periodically, the Audit Committee reviews our policies with respect to risk assessment, risk management, cybersecurity risk, and regulatory compliance. Oversight by the Audit Committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The Compensation Committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The Nominating and Governance Committee manages risks associated with the independence of the Board, corporate disclosure practices, and potential conflicts of interest. The Product Safety Committee manages risks associated with the products we manufacture and distribute. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board as a whole.

Board Committees

Below is a summary of our standing committees’ responsibilities, their present membership and leadership, and changes to the committees’ membership and leadership that occurred during the fiscal year ended November 30, 2022.

Audit Committee

Our Audit Committee is established in accordance with Section 3(a)(58)(A) of the Exchange Act and Rule 5605(c) of the Marketplace Rules of Nasdaq. It exercises sole authority with respect to the selection, appointment, oversight of and, where appropriate, replacement of the Company’s independent registered public accounting firm and the terms of its engagement including compensation; reviews the policies and procedures of the Company and management with respect to maintaining the Company’s books and records and cybersecurity; reviews with the independent registered public accounting firm, upon the completion of its audit, the results of the auditing engagement and any other recommendations the independent registered public accounting firm may have with respect to the Company’s financial, accounting or auditing systems; and reviews with the independent registered public accounting firm, upon the completion of its quarterly review of the Company’s financial statements, the results of the quarterly review and any other recommendations the independent registered public accounting firm may have in connection with such quarterly reviews. Our Audit Committee also is responsible for, among other things, assisting our Board of Directors with oversight of: (1) the integrity of our financial statements; (2) legal, ethical and risk management compliance programs; (3) our systems of internal accounting and financial reporting control. The Audit Committee meets periodically with selected members of management, including the CFO, CEO, and others to discuss risk topics, including cybersecurity procedures, supply chain vulnerabilities, material weaknesses if any, and any risks identified to it by management or by the Company’s independent registered public accounting firm. The Committee also receives whistleblower reports and oversees compliance with the Company’s insider trading program among other things.

PROPOSAL 1: ELECTION OF DIRECTORS

Our current Audit Committee members are Herbert Hughes (Chair), Chris Lavern Reed, and Leonard Elmore. Effective as of June 17, 2022, Mr. Elmore was appointed to succeed Ms. Rooney as the third independent member of the Audit Committee. Each of these present, former, and future Committee members is “independent” within the meaning of Rule 10A-3 under the Exchange Act and Rule 5605(a)(2) of the Marketplace Rules of Nasdaq. Our Audit Committee has been 100% independent pursuant to the applicable Nasdaq rules since July 2019. Our Nominating and Governance Committee and the Board have determined that Herbert Hughes is an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K and that each of the other committee members has the level of “financial literacy” required by the applicable rules and regulations of the SEC. During fiscal year 2022, each current member of the Audit Committee was present at 100% of the Audit Committee meetings held during such director's tenure as a member of the Audit Committee.

Compensation Committee

Our Compensation Committee is responsible for, among other things: (1) reviewing and approving compensation levels of our Chief Executive Officer and other executive officers, including salaries, participation in incentive compensation plans and other forms of compensation; (2) reviewing and approving the corporate goals and objectives with respect to compensation for our executive officers; and (3) reviewing and recommending to the Board any changes to the compensation of our non-employee directors. The Compensation Committee also administers our equity incentive plan.

Many key compensation decisions are made during the first quarter of the fiscal year as the Compensation Committee meets to: review performance for the prior year, determine awards under our incentive plans, and set compensation targets and objectives for the coming year. However, our Compensation Committee also views compensation as an ongoing process and may convene special meetings in addition to its regularly scheduled meetings throughout the year for purposes of evaluation, planning and appropriate action. The Compensation Committee meets with the Chief People Officer on topics related to Human Capital Resources including employee turnover, retention or recruitment challenges, diversity, employee satisfaction, and new benefits under consideration. In response to the challenges to recruitment and retention of key personnel posed by the current work force shortage, during 2022, the Committee engaged Frederic W. Cook & Co., Inc. (“FW Cook”), an independent compensation consultant to review and make recommendations to support retention and recruitment.

The members of our Compensation Committee are Chris Lavern Reed (Chair) and Herbert Hughes. Effective as of June 17, 2022, Mr. Reed was appointed to succeed Mr. Hughes as Chair. Each of these Committee members is “independent” within the meaning of Rule 10A-3 under the Exchange Act. In addition, each member of our Compensation Committee qualifies as a “non-employee director” under Rule 16b-3 of the Exchange Act and is “independent” as defined by Rule 5605(a)(2) of the Marketplace Rules of Nasdaq. Our Compensation Committee has been 100% independent pursuant to the applicable Nasdaq rules since July 2019. During fiscal year 2021, each member of the Compensation Committee was present at 100% of the Compensation Committee meetings held during such director's tenure as a member of the Compensation Committee.

Nominating and Governance Committee

Our Nominating and Governance Committee is responsible for assisting our Board of Directors by: (1) identifying individuals qualified to become members of our Board of Directors and its committees; (2) recommending to our Board of Directors nominees for election to the Board at the annual meeting of stockholders; and (3) assisting our Board of Directors in assessing director performance and the effectiveness of the Board of Directors as a whole. The Committee annually reviews the Board’s and each Committee’s charter and composition in terms of the to evaluate the breadth and depth of its substantive knowledge on topics related to general financial risk management, risks specific to the Company, strategic direction and other matters related to its oversight and guidance of management, as well as in view of developments in the business and the legal and regulatory environment and makes recommendations to Committees and the Board to improve oversight and strengthen its resources. The Nominating and Governance Committee also works to develop programs and policies elated to environmental, governance, and social topics. While the Board currently consists of one member of management and four independent directors, the board evaluates candidates brought to its attention on a rolling basis and may recommend additional Board members to provide relevant expertise and experience. Diversity of background, experience, gender, gender identity, and racial and ethnic identity are considered by the Committee in board recruitment. The board’s five current members include individuals with diverse backgrounds in manufacturing, finance, business, law, public service, the media, and law enforcement. Four individuals add racial, ethnic or gender diversity: one woman, two men who identify as African American, and one man who identifies as both Native American and white.

PROPOSAL 1: ELECTION OF DIRECTORS

The current members of our Nominating and Governance Committee are Leonard Elmore (Chair), Chris Lavern Reed, Emily Rooney, and Herbert Hughes. Effective as of June 17, 2022, Mr. Elmore was appointed to succeed Mr. Reed as Chair of the Nominating and Governance Committee and Ms. Rooney joined the committee. All current and new members of the Nominating and Governance Committee are “independent” as defined by Rule 5605(a)(2) of the Marketplace Rules of Nasdaq. Prior to December 1, 2021, the Nominating and Governance Committee was 100% independent pursuant to SEC standards but not pursuant to applicable Nasdaq standards because the Board had found it in the Company’s best interests, when it began trading on Nasdaq, for Mr. Jensen to remain on the Nominating and Governance Committee until the end of the fiscal year because the other committee members at the time, Clive Bode and Chris Lavern Reed, had served on the Board for less than a year.

Product Safety Committee

Our Product Safety Committee, formed in December 2022, is responsible for assisting the Board with its oversight responsibilities related to the safety of products manufactured in house for consumer use, including the establishment and maintenance of safety-related policies, procedures, reporting systems for ongoing oversight, safety-related crisis management, customer warnings, and product recalls, and any legal and regulatory requirements related to the safety of the products manufactured and produced and services offered by the Company (collectively, “products”). The committee meets with such members of management and the Company’s operations and technical management personnel as it sees fit to review topics relevant to its responsibilities and reports on such matters to the board for further discussion and. The Committee may engage outside advisors to assist the Company in compliance with the Consumer Product Safety Act and to assist its members in understanding such legal and regulatory environment as is relevant to the safety of the Company’s products. The current members of the committee are Emily Rooney (Chair) and Chris Lavern Reed, each of whom is independent, and Bryan Ganz. Mr. Elmore served as a member of the Product Safety Committee from December 2021 to June 2022.

Codes of Business Conduct and Ethics; Insider Trading Policy; Hedging Prohibition

Our Board has adopted a Code of Business Conduct and Ethics and an Insider Trading Policy that apply to our directors, consultants, and employees, including our Chief Executive Officer and Chief Financial Officer. A copy of our Code of Business Conduct and Ethics is available free of charge on our website at ir.byrna.com and is provided to all employees upon commencement of employment. We intend to disclose any amendment to or waiver from a provision of our Code of Business Conduct and Ethics that requires disclosure on our website at ir.byrna.com. The Company also has a formal Whistleblower Policy and Whistleblower Hotline. The Audit Committee reviews any information left on the Whistleblower Hotline. Our Insider Trading Policy, which applies to all employees, consultants, and directors, prohibits disclosure of or trading in the Company’s securities on the basis of material non-public information. It also prohibits short sales, trading in derivative securities, hedging, using Company securities as collateral for loans without prior written approval, holding Company securities in margin accounts, and placing open orders except in accordance with an approved 10b5-1 plan. Pursuant to the policy, all covered persons are required to pre-clear all trades in our securities and entry into any 10b5-1 plans and are subject to regular quarterly blackout periods as well as special blackout periods when appropriate. All employees sign an acknowledgement of receipt of the Insider Trading Policy upon commencement of employment, as well as a Business Protection Agreement regarding the Company’s confidential and proprietary information, trade secrets, and intellectual property.

Director Independence

Our Board of Directors is comprised of a majority of independent directors as defined in Rule 5605(a)(2) of the Marketplace Rules of Nasdaq and has had a majority of independent directors since July 2019. Four out of our five directors are independent. Our Board of Directors has reviewed the independence of our directors under the applicable standards of Nasdaq. Based on this review, our Board of Directors determined that each of the following directors is independent under those standards: Herbert Hughes, Chris Lavern Reed, Leonard Elmore, and Emily Rooney. Our Compensation Audit and Nominating and Governance Committees are 100% comprised of independent directors. From December 2021 to June 2022, Herbert Hughes served as Lead Independent Director, and on June 17, 2022, Mr. Hughes was appointed to succeed Mr. Ganz as Board Chair.

PROPOSAL 1: ELECTION OF DIRECTORS

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has in the past served as an officer or employee of our Company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

Director Engagement

Our Board of Directors met 11 times during fiscal year ended November 30, 2022 and also acted by unanimous written consent. Over the past 12 months one Board meeting was held at each of the Company’s primary domestic facilities in Andover, MA, Fort Wayne, IN, and Las Vegas, NV and included tours of the facilities and engagement with local management and other employees. Each director was present for at least 75% of the Board of Directors meetings and the meetings of the committees on which each director sits. Executive sessions or meetings of outside (non-management) directors without management present are included on the agenda for each regularly scheduled Board of Directors meeting for a general discussion of relevant subjects. During fiscal year 2022, the independent directors held 7 executive sessions without management present, 3 of which included meeting with the Company’s independent auditors. The Compensation Committee also meets in executive sessions on compensation related matters with its outside advisors, in addition to regularly scheduled meetings.

During the fiscal year ended November 30, 2022, the Board had the following standing committees: an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, and a Product Safety Committee. During the fiscal year ended November 30, 2022, the Audit Committee met 6 times, the Compensation Committee met 8 times, and the Nominating and Governance Committee met 3 times as a committee, and the Product Safety Committee met 4 times.

Submission of Stockholder Recommendations for Director Candidates

The Nominating and Governance Committee has established procedures for stockholders to recommend director candidates. All stockholder recommendations for director candidates must be submitted in writing to our Corporate Secretary at 100 Burtt Road, Suite 115, Andover, MA 01810, who will forward all recommendations to the Nominating and Governance Committee. All stockholder recommendations for director candidates must be submitted to the Company not less than 120 calendar days prior to the anniversary of the date on which our proxy statement was released to stockholders in connection with the previous year’s annual meeting. All stockholder recommendations for director candidates must include:

|

● |

the name and address of record of the stockholder; |

|

|

● |

a representation that the stockholder is a record holder of our securities, or if the stockholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934; |

|

|

● |

the name, age, business and residential address, educational background, public company directorships, current principal occupation or employment, and principal occupation or employment for the preceding five full fiscal years of the proposed director candidate; |

|

|

● |

a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership approved by the Board of Directors and set forth in the Nominating and Governance Committee charter; |

PROPOSAL 1: ELECTION OF DIRECTORS

|

● |

a description of all arrangements or understandings between the stockholder and the proposed director candidate; |

|

|

● |

the consent of the proposed director candidate to be named in the proxy statement, to have all required information regarding such director candidate included in the proxy statement, and to serve as a director if elected; and |

|

|

● |

any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the SEC. |

The Nominating and Governance Committee will evaluate all such proposed director candidates, including those recommended by stockholders, in compliance with the procedures established by the Nominating and Governance Committee, in the same manner, with no regard to the source of the initial recommendation of such proposed Director candidate. When considering a potential candidate for membership on the Board of Directors, the Nominating and Governance Committee may consider, in addition to the minimum qualifications and other criteria for Board membership approved by the Board of Directors, all facts and circumstances that the Nominating and Governance Committee deems appropriate or advisable, including, among other things, the skills of the proposed director candidate, his or her availability, depth and breadth of business experience or other background characteristics, his or her independence and the needs of the Board of Directors. At a minimum, each candidate must have high personal and professional integrity, have demonstrated ability and judgment, and be effective, in conjunction with the other directors and candidates, in collectively serving the long-term interests of the stockholders. In addition, the Nominating and Governance Committee will recommend that the Board select candidates for nomination to help ensure that a majority of the Board shall be “independent” in accordance with Nasdaq rules and that each of its Audit, Compensation and Nominating and Governance Committees shall be comprised entirely of independent Directors, subject to certain exceptions under the Nasdaq rules to such requirement. Although there is no specific policy regarding the consideration of diversity in identifying Director candidates, the Nominating and Governance Committee may consider whether the candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. The Nominating and Governance Committee also may consider whether the candidate has direct experience in the industries or in the markets in which the Company operates. The Company does not pay any fees to third parties to identify or evaluate potential nominees.

Stockholder Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate with the Board of Directors may do so by sending a written communication to any director at the following address: Corporate Secretary, Byrna Technologies Inc., 100 Burtt Road, Suite 115, Andover, MA 01810. The mailing envelope should contain a notation indicating that the enclosed letter is a “Board Communication.” All such letters should clearly state whether the intended recipients are all members of the Board of Directors or certain specified individual directors. Our Corporate Secretary or her designee will make a copy of any such communication so received and promptly forward it to the director or directors to whom it is addressed.

Committee Charters

The Board has adopted, and may amend from time to time, a written charter for each of the Nominating and Corporate Governance Committee, Audit Committee, Compensation Committee and Product Safety Committee. Byrna maintains a website at www.byrna.com. Byrna makes available on its website, free of charge, copies of each of these charters.

CORPORATE GOVERNANCE

Our Corporate Citizenship

We have experienced enormous growth over a relatively short period as we rapidly progressed from what was primarily a research and development stage company with a narrow focus on a highly regulated product to a consumer and public safety focused technology company with operations on two continents, multiple products, and an exciting product pipeline. We take pride in what we have achieved but believe we remain in our infancy relative to the potential growth in our future.

We are committed to exceeding the expectations of you, our stockholders, our employees, and the communities in which we live and work. Every day we strive as a team to develop and deliver innovative tools and educational and training programs to facilitate safer policing, safer schools, safer communities, and safer living. Our goal is simple: to reduce the lethal consequences that result from deployment of lethal weapons by developing simple, effective and affordable tools and training for personal safety, community safety, and criminal apprehension.

We have not yet adopted any formal objectives for environmental sustainability. However, we have undertaken several projects directed at environmental sustainability and employee and public health and safety including introduction of our water soluble eco-kinetic round (the first environmentally friendly less lethal round, intended to reduce our contribution to the environmental challenge presented by the build-up of non-biodegradable plastic debris. In response to the COVID-19 pandemic we initiated various facility-related operational and cleaning protocols and policies and provided our employees with PPE and covid testing. We added Sezzle® as a payment option to facilitate access to our products to people who might not otherwise be able to afford them. We also donate 10% of the revenue from our school safety initiative to Meadow’s Movement to deter school gun violence.

Our Team: Human Capital Management

Talent Acquisition, Engagement, and Retention

Our team is critical to the Company’s ability to meet its strategic goals including growing revenues, improving margins and simplifying day-to-day processes to maximize efficiency. Our Board and our Human Resources Department, led by our Chief People Officer, Sandra Driscoll, work to further our key human capital management priorities: talent acquisition and retention, diversity and inclusion, engagement and collaboration, and development. We use a variety of recruiting and retention tools to engage and retain our human capital including recruiters, employee referrals, short and long-term incentive programs, a full suite of health benefits, and a comfortable workplace with various amenities and features to encourage collaboration and collegiality. In the U.S., in addition to initiatives related to compensation and the physical work environment, we seek to support our employees by providing benefits, services and, in some cases, flexible work arrangements to support our employees with personal or work-related issues. Our benefit programs include a range of support services related to mental and emotional well-being.

We are continuously engaged in efforts to provide opportunities and awards to improve the Company’s recruitment and retention of critical talent globally. In February 2022, our Compensation Committee retained FW Cook, an independent compensation consultant, to make recommendations to support retention and recruitment. We have rolled out a global Employee Retention Grant Program to provide better motivational and retention tools in the medium and short range as a result of FW Cook’s recommendations. Additionally, we have untaken several key projects to support and incentivize our people, including the recently completed move of Fort Wayne manufacturing and customer support teams to a new, state of the art facility with better workplace amenities, implementation of company-wide, cloud-based systems to improve safety and security, and new software and hardware to facilitate management of inventory, production and shipping operations.

We continue to invest in our human capital by offering an online learning platform, which currently offers a number of self-guided courses of study designed to facilitate the personal and professional development of our employees. These include programs on stress management, workplace conflict management, intergenerational communication skills, collaboration and teambuilding, time management, planning and organizing, listening skills, negotiating skills, presentation skills and e-mail best practices, as well as modules specifically for managers and supervisors.

Diversity and Inclusion

Byrna embraces diversity and equal opportunity. We view diversity in our team as an important contributor to innovation and seek to encourage all team members to offer bring their background, experience, diverse skills, and perspective to the workplace. Our Human Resources department is in the process of building out programs designed to make all employees comfortable in expressing their views and collaborating so that they can develop and thrive in the workplace. On an annual basis, all employees are required to participate in training directed at preventing discrimination and harassment and understanding bias, with special training for managers on leadership’s role in preventing discrimination and workplace harassment. With under 100 employees in the United States, the Company does not report metrics to the EEOC.

REPORT OF THE AUDIT COMMITTEE

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or any future filing with the Securities and Exchange Commission, in whole or in part, the following report shall not be deemed incorporated by reference into any such filing.

The undersigned members of the Audit Committee of the Board of Directors of the Company submit this report in connection with the committee’s review of the financial reports of the Company for the fiscal year ended November 30, 2022 as follows:

|

1. |

The Audit Committee has reviewed and discussed with management the audited financial statements of the Company for the fiscal year ended November 30, 2022. |

|

2. |

The Audit Committee has discussed with representatives of EisnerAmper LLP the matters required to be discussed with them by applicable requirements of Public Company Accounting Oversight Board Auditing Standard No. 16. |

|

3. |

The Audit Committee has received the written disclosures and the letter from the independent accountant required by the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant’s independence. |

|

4. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2022 for filing with the Securities and Exchange Commission. |

Submitted by the Audit Committee:

Herbert Hughes, Chairman of the Audit Committee